Portfolio Update: Position Changes and Investment Outlook for 2025

In this letter we share some thoughts from the Portfolio Managers at Broad Run Investment Management, LLC, the Fund’s sub-advisor.

-

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager -

Brian Macauley, CFACo-Portfolio Manager

Brian Macauley, CFACo-Portfolio Manager -

Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager

January 2025

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end, and standardized performance can be obtained by viewing the fact sheet or by clicking here. Neither forward earnings nor earnings growth is a measure of a fund’s future performance.

The Hennessy Focus Fund (HFCIX) was up 15.21% for 2024. We believe this is a good level of absolute returns, but we did trail our benchmark indices (Russell Midcap® Growth Index up 22.10%, Russell 3000® Index up 23.81%) for the year. Results relative to these indices would have been better but for the fourth quarter. The fund was down 5.20% in the fourth quarter while the Russell 3000 Index was up 2.63%, and the Russell Midcap Growth Index was up 8.14%.

During the fourth quarter our rate sensitive stocks lagged due to the changing interest rate expectations spurred by the Presidential election outcome. Trump administration policies are likely inflationary, but they are also pro-growth. So, we expect these short-term rate headwinds to eventually yield net benefits for our portfolio, including for our more cyclical and rate sensitive holdings.

When we step back for a broader perspective, we believe that our portfolio is well-positioned. This is not because of factor exposures or macro expectations. Rather, it is because we believe we have a higher-than-normal concentration of positions in the portfolio that are significantly misunderstood and mispriced by the market. We expect strong individual business performance to carry the portfolio to good absolute and relative results in the intermediate term.

As we do every fourth quarter, in this letter we provide an update on our portfolio earnings progress, including some more details on how we fared in 2024, where we stand over a longer-term basis, and our outlook for earnings and investment performance looking forward. We also discuss our decision to add to our position in Altus Group during the quarter.

Portfolio Earnings Update

As we have discussed in the past, investment returns for equities can be broken down into three factors: growth in earnings, dividends, and change in valuation. In the short term, change in valuation can have a meaningful impact on investment results, but in the long term, change in valuation becomes much less important as growth in earnings and dividends accumulate to drive the majority of results.

For this reason, as long-term investors, our analytical focus is on trying to understand a business’s future earnings and dividends. We track how these metrics develop at each business we own, in aggregate across all the businesses we own, and at the portfolio level taking into account the impact of cash. This analysis helps us understand how these businesses are performing by providing a measure of progress independent of the vicissitudes of the stock market. At the end of each year, we report a summary of this information to give you additional perspective on your investment with us.

Please note, in this letter when we refer to “earnings” or “EPS” for our businesses, we mean earnings on a per-share basis, adjusted for certain items. We make these adjustments to arrive at what we believe to be a better measure of the true economic earnings of the businesses.

In aggregate, we estimate our portfolio EPS grew 7.2% and we received 1.0% in dividends, totaling to an 8.2% increase in earnings power value. The Russell 3000 Index was slightly ahead of this this year with 8.2% EPS growth and a 1.3% dividend yield, totaling to a 9.4% increase in earnings power value.1 We will note that AST SpaceMobile, a 10.3% holding for us, is a non-earning business, so any change in its intrinsic value is not well captured using this earnings-based methodology.

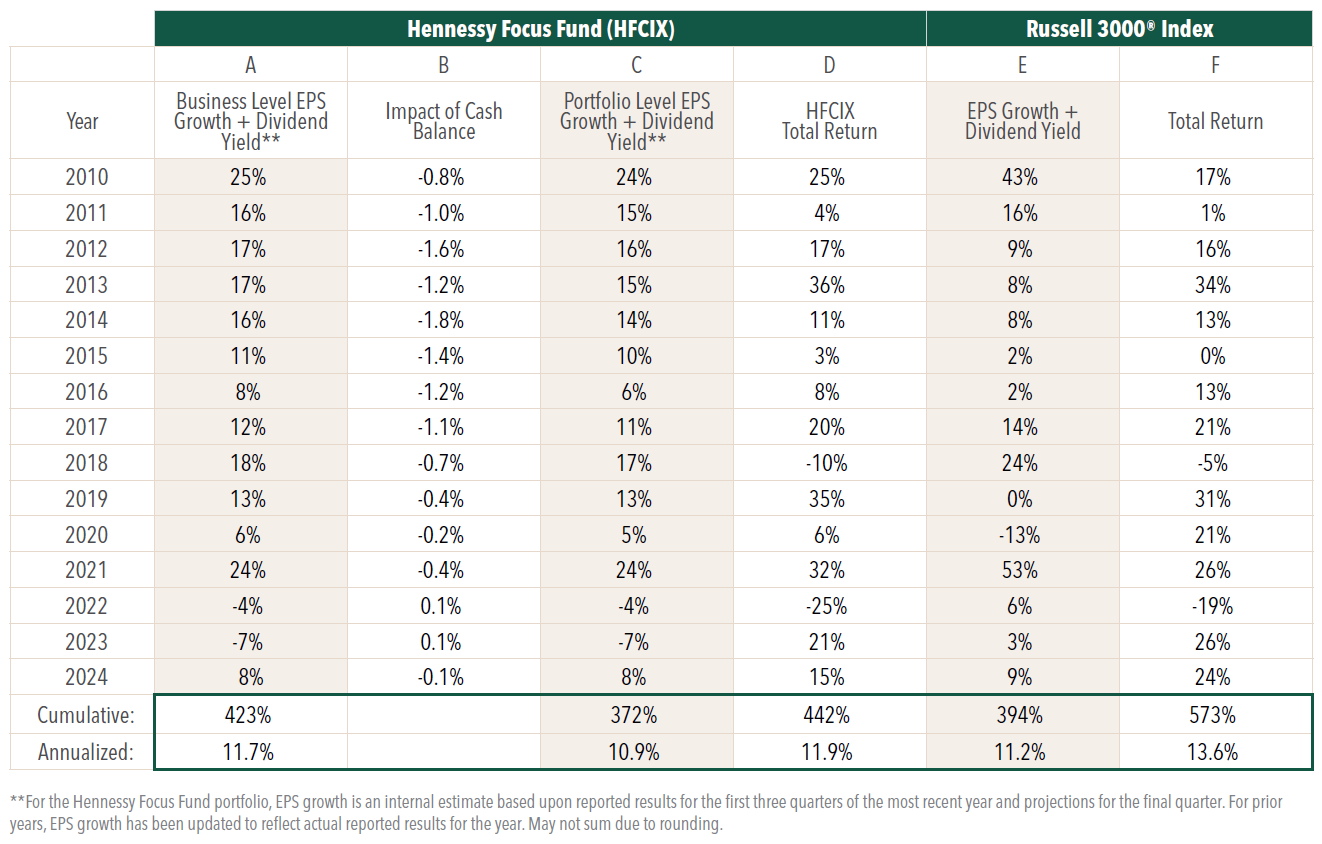

As a reminder, we underwrite our investments to target a mid-teens rate of return. We seek this return via the compounding of earnings over time rather than through a change in valuation or by cleverly trading in or out of a stock. As a result, our long-term portfolio performance is primarily driven by the earnings growth of the underlying businesses that we own.2 You can see this relationship in the table on the previous page. Over the last fifteen years, our portfolio level EPS CAGR is 10.9%, inclusive of dividends and cash drag [column C], compared to a realized total return of 11.9% [column D]. Please note that there is a loose relationship between earnings power and price performance in any given year, but that relationship strengthens considerably over longer periods of time.

Investment Outlook

Our objective is to own a portfolio of businesses that deliver a mid-teens rate of compounding over the long term, without incurring significant risk of permanent capital loss. We remain steadfast in this pursuit, and believe that we are well-positioned to deliver over time.

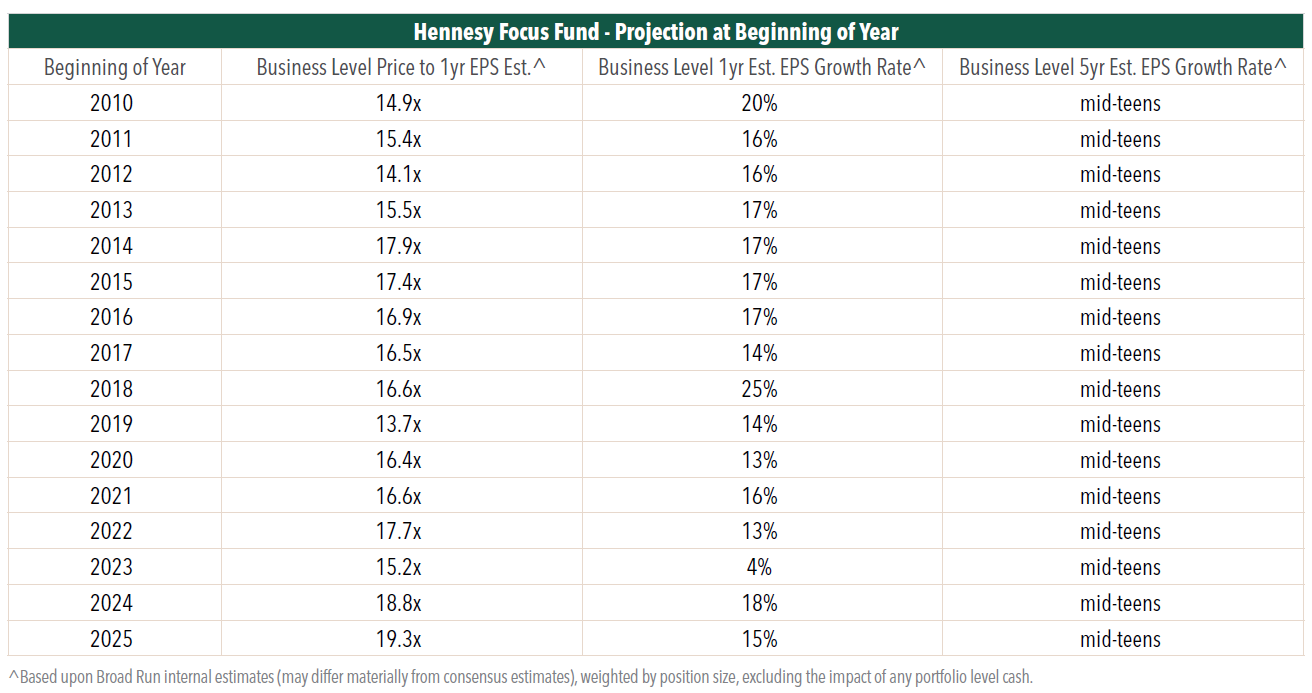

At year end, our portfolio is trading at 19.3x our 2025 earnings estimates, compared to 21.4x for the Russell 3000 Index. From this valuation level, we expect portfolio returns will roughly align with the rate of earnings growth produced by our portfolio over the next five years. We are forecasting a 15% rate of earnings growth for our portfolio in 2025, with a mid-teens rate over the five-year period.

Portfolio Change: Added to Altus Group

During the quarter, we increased our Altus Group position from 1.1% to 1.6% of assets due to our growing confidence in our investment thesis.

You may recall that we initiated a position in Altus during the third quarter of 2023. At the time, Altus had three primary lines of business: a tax appraisal service, VMS, and Argus. Our primary interest was in VMS and Argus, two high quality businesses with good growth and opportunities for innovation. In contrast, we viewed tax appraisal as a stable but mature cash cow.

In mid-2024, Altus announced a transaction to sell its tax appraisal business for $500 million in net proceeds (closed January 2, 2025). We welcome this transaction. It provides enhanced exposure to the two Altus businesses we are most interested in, while delivering a fair price for the one business that was not core to our thesis.

We have continued our research on Altus during our ownership. Early in the fourth quarter, we attended the company’s annual client event in Boston. We had an opportunity to see the company’s important new product, Argus Intelligence, and to speak with many customers and employees. We came away optimistic about the potential for Argus Intelligence, and with an enhanced appreciation for the quality of the overall Altus franchise.

Later in the fourth quarter, we noticed online posts (X and Reddit) from some Argus clients citing new pricing and product bundling upon contract renewals. After speaking with the company and conducting our own channel checks, we concluded that this was a potential watershed moment for Argus. It appears that the new pricing plan (a) bundles Argus Intelligence into the base Argus product, (b) moves from a per seat license to a per asset license based on the property value, and (c) increases pricing by 12-13%.

Our initial assessment is that this change is likely to be successful across a significant portion of Argus clients, driving increased product utilization and accelerated revenue growth. While a low double-digit price increase is fairly modest, we believe that this could be just the beginning of a long-term, virtuous cycle of product enhancements driving increased value for clients, followed by increased pricing.

As a result of these learnings, we have increased confidence that Altus can grow revenue at a high single-digit rate, and cash EPS at a mid-teens rate over the next 7-10 yrs. While the stock, at 26x earnings, trades at a premium to the market, we believe that premium is justified by the quality and growth characteristics of the business. A peer group of similar information services and analytics businesses trade at higher multiples, implying there is possible upside from a valuation re-rating (though that is not part of our base-case underwriting).

Click here for a full listing of Holdings.

Click here for full, standardized Fund performance.

- In this article:

- Domestic Equity

- Focus Fund

1 May not sum due to rounding.

2 This is axiomatic: if there is no change in valuation and no dividends, stock performance will match the change in earnings per share. While EPS growth is not particularly useful to measuring progress at many types of investment strategies – for example, a high valuation-high growth strategy, a slow/no growth-deep value strategy, or a high turnover strategy – it is instructive for our strategy of long-term ownership of generally profitable business.

You might also like

-

Portfolio Perspective

Portfolio Perspective

Focus FundLong-term Investing in a Concentrated Collection of Businesses

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Commentary

Brian Macauley, CFACo-Portfolio ManagerRead the CommentaryIn the following commentary, the Portfolio Managers of the Hennessy Focus Fund summarize the 2024 market and provide their insights on their 2025 outlook, including the impact on holdings from presidential administration’s policy changes and the growth of AI.

-

Viewpoint

ViewpointHidden Gems: The Hennessy Cornerstone Mid Cap 30

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager L. Joshua Wein, CAIAPortfolio ManagerWatch the Video

L. Joshua Wein, CAIAPortfolio ManagerWatch the VideoLearn more about the Hennessy Cornerstone Mid Cap 30 Fund, a top-performing strategy that uses a transparent, consistent, disciplined approach to identify undervalued mid and small-cap companies. Portfolio Managers Ryan Kelly and Josh Wein explain their time-tested formula and discuss why it consistently outperforms the market.

-

Portfolio Perspective

Portfolio Perspective

Cornerstone Mid Cap 30 FundPortfolio Drivers: Consumer Discretionary and Industrials

Neil J. HennessyChief Market Strategist and Portfolio Manager

Neil J. HennessyChief Market Strategist and Portfolio Manager Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryCornerstone Mid Cap 30 Fund Portfolio Managers Ryan Kelley and Josh Wein review the Fund’s investment strategy, discuss the most recent rebalance, and highlight fundamental drivers of the portfolio.