Undervalued and Overlooked: Why We Believe Now is the Time to Invest in Japanese Small and Mid-Cap Stocks

In the intricate tapestry of global markets, Japanese small and mid-cap stocks present a particularly compelling narrative. Often overshadowed by their larger counterparts, we believe these stocks offer unique growth opportunities that savvy investors are starting to notice.

-

Takenari Okumura, CMAPortfolio Manager

Takenari Okumura, CMAPortfolio Manager -

Tadahiro Fujimura, CFA, CMAPortfolio Manager

Tadahiro Fujimura, CFA, CMAPortfolio Manager

Key Takeaways

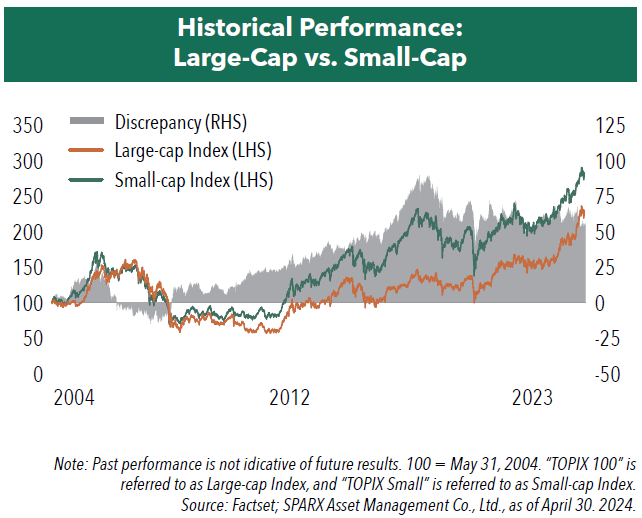

» Japanese small-caps have been undervalued compared to large-caps for the past three years.

» Historically smaller companies in Japan have outperformed their larger counterparts due to higher earnings per share growth rates.

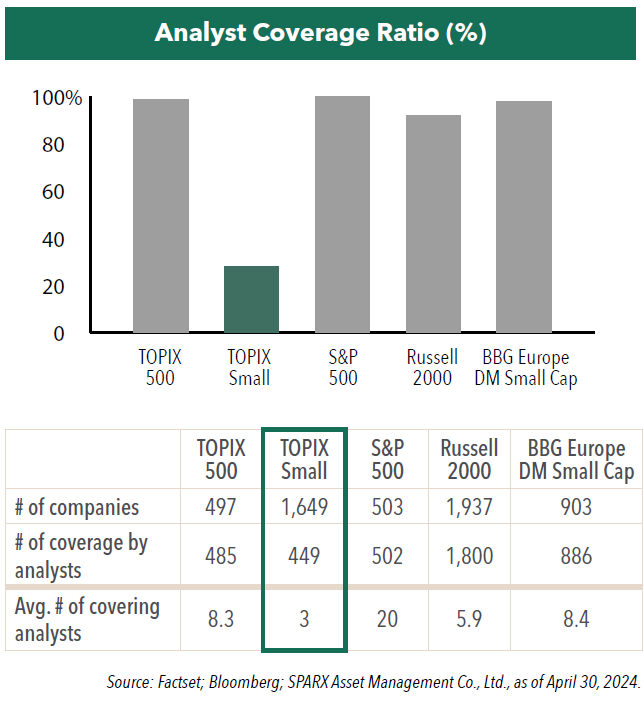

» We believe there are numerous hidden investment opportunities in the Japanese small-cap market as they are underfollowed by analysts.

The Undervalued Potential

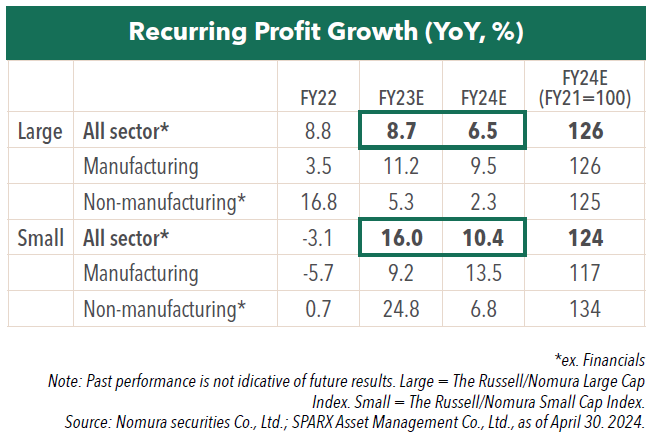

Japanese small and mid-cap stocks are currently in an intriguing position. Despite showing significant growth potential, they remain undervalued compared to large-cap stocks. Over the past three years, while small-cap stocks have been consistently undervalued, they are demonstrating higher profit growth expectations than large-caps going forward. This dichotomy suggests a misalignment in market valuation that could present lucrative opportunities for savvy investors.

Historical Context and Long-term Performance

Historically, Japanese small-cap stocks have not only provided substantial returns but have also outperformed large-cap stocks. This trend is largely attributed to their higher earnings per share (EPS) growth rates. Despite this, the market’s hesitance to value these stocks appropriately may stem from a prolonged period of economic stagnation, exacerbated by the impacts of the global pandemic on the Japanese economy.

The Untapped Potential of Japanese Small and Mid-Cap Stocks

One of the most significant characteristics of Japanese small and mid-cap stocks is that they are overwhelmingly under-covered by analysts. This chart shows the analyst coverage ratio for major indices in Japan, the U.S., and Europe. For the TOPIX Small Index, over 70% of the stocks have no analyst coverage. Additionally, the table below highlights the low number of analyst coverage per stock. This indicates that there are numerous hidden investment opportunities in the Japanese small-cap market.

Economic Challenges and Opportunities

Due to the impact of COVID-19, the Japanese economy has faced significant headwinds led by disruptions in supply chains and a lag in economic activities, especially among small to medium-sized enterprises. Notably, the industrial production has not rebounded to pre-pandemic levels yet, lagging Western counterparts. However, with the pandemic-related constraints resolving and the earnings environment improving, it is expected there is a shift coming that could reinvigorate interest in these undervalued stocks.

Investment Strategies and Stock Picking

For the Hennessy Japan Small Cap Fund, sub-advisor SPARX Asset Management’s strategy is to actively seek out undervalued stocks that the market has overlooked. Through meticulous bottom-up research, the Fund identified companies poised for growth, focusing on those that can navigate through current economic challenges and capitalize on emerging opportunities. For instance, companies like Tadano have demonstrated resilience and strategic foresight by adjusting their business models to overcome supply chain disruptions and are now poised for recovery.

Case Study

Tadano, a leading company in lifting equipment, holds an approximately 40% market share in Japan and 20% globally. In 2019, they acquired Demag, a major crane business operator in Germany, aiming to accelerate growth as a comprehensive lifting equipment company. However, the COVID-19 pandemic brought significant challenges, including difficulties in procuring parts and rising costs, which severely impacted their productivity and profitability, leading to substantial profit declines.

It took three years to improve productivity due to the need to find alternative suppliers and redesign products to use substitute components. Additionally, delays in passing on costs further deteriorated their performance. While price revisions were made for new orders, it was challenging to adjust prices for existing backorders, resulting in continued profit margin decline.

By the 2023 fiscal year, supply chain issues were nearly resolved, and Tadano is returning to its original profitability. The remaining challenge is their European business, which is still projected to be unprofitable this fiscal year. However, eliminating these losses alone implies a potential profit increase, providing significant upside potential for future earnings, in my view. Although the stock price has seen some recovery, the price-to-book ratio is still below one time. We believe the stock price will rise with continued performance improvement.

An Opportunity to Benefit

We believe Japanese small and mid-cap stocks offer unique growth opportunities and appear attractively valued compared to large-cap stocks. Historically, these stocks have outperformed against large-caps led by higher earnings growth. Companies like Tadano, which have faced significant challenges during the COVID-19 pandemic, are now poised for recovery.

As supply chain issues resolve and economic conditions improve, these stocks would present significant upside potential.

One way to access these undervalued Japanese small-cap companies is through the Hennessy Japan Small Cap Fund. SPARX’s bottom-up research identifies companies ready for growth, making Japanese small and mid-cap stocks a compelling investment opportunity.

- In this article:

- Japan

- Japan Small Cap Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Japan FundJapan’s Evolving Investment Landscape in 2025

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio ManagerRead the Commentary

Angus Lee, CFAPortfolio ManagerRead the CommentaryIn the following commentary, the Hennessy Japan Fund Portfolio Managers summarized what most surprised them in 2024 about the Japanese market along with positive trends driving Japanese companies.

-

Portfolio Perspective

Portfolio Perspective

Japan Small Cap FundJapanese Small-Caps: Attractive Valuations with Potential for Sustained Growth

Takenari Okumura, CMAPortfolio Manager

Takenari Okumura, CMAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the Commentary

Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the CommentaryThe Portfolio Managers summarize the 2024 Japanese market and discuss the compelling opportunities they are finding in undervalued Japanese small-cap companies.

-

Investment Idea

Investment IdeaCompelling Valuations in Japan

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio Manager

Tadahiro Fujimura, CFA, CMAPortfolio Manager Takenari Okumura, CMAPortfolio ManagerRead the Investment Idea

Takenari Okumura, CMAPortfolio ManagerRead the Investment IdeaJapanese equities are currently trading at compelling valuation levels compared to other developed equity markets around the world and relative to their own historical averages. We believe the Japanese market deserves a closer look.