2024 CIO Roundtable

This year marked the 10th Annual CIO Roundtable where our distinguished Portfolio Managers gathered to share their perspectives on the market and economy.

The group’s thought-provoking discussion included a wide range of topics that covered the U.S. equity and bond markets, the recent U.S. presidential election, inflation, and interest rates, along with individual sectors including Energy, Financials, and the Japanese market. We were pleased to have Portfolio Managers represented across all of our 17 mutual funds and ETFs. Of note, traveling the farthest this year was Masa Takeda and Takenari Okumura, Portfolio Managers of our Japan Funds who joined us from Hong Kong and Tokyo.

Message from our CIO

In 2024, the stock market stands out with exceptional performance, characterized by strong gains across indices.

Through November 30, 2024, all three broad based indexes had double-digit returns: The Dow Jones Industrial Average rose 21%, the S&P 500® Index increased 28%, and the Nasdaq Composite Index surged nearly 29%. While large-caps initially outperformed mid- and small-caps in the first half of the year, toward the end of the year, smaller-cap indices rallied.

During our Roundtable discussion, nearly all our Portfolio Managers were optimistic about stocks heading into next year. Consumer demand and spending remain resilient, wages continue to increase, and unemployment numbers remain historically low. In addition, continued interest rate cuts from the Federal Reserve are expected, which would be a positive tailwind for stocks. Lastly, as investors anticipate potentially less government regulation, lower corporate tax rates, and a pro-business climate, we believe that positive momentum could continue throughout 2025.

While volatility and uncertainty may affect the markets at any time, we encourage investors to keep a long-term perspective and maintain a diversified portfolio.

We hope you enjoy the following perspectives from our team of talented and seasoned Portfolio Managers.

Ryan C. Kelley, CFA

Chief Investment Officer

2024 Economic and Market Summary

With the excitement around the development of artificial intelligence (AI), this year’s market performance toward the beginning of the year was primarily driven by a few mega-cap technology companies dubbed the “Magnificent 7” (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla). Through November, the Mag 7 rose on average about 54%, nearly double the overall S&P 500’s 28% return.

In recent months, smaller companies have been outperforming their larger peers. This newer trend favoring smaller companies may partially reflect the fact that many large-caps appear to be overvalued.

There may be a case for small and mid-cap stocks to continue to outperform. In terms of sector concentration, the small and mid-cap indices have a significantly different profile than large-caps. The S&P 500 Index is heavily concentrated in Technology, which comprises 32% of the index as of November 30, 2024. Conversely, typically medium and small-cap indexes have less exposure to Technology and are generally more evenly distributed across many sectors. In particular, both the Russell Midcap® and the Russell 2000® Indices have significant weightings in Financials and Industrials, which combined comprise approximately 37% and 34%, respectfully. Lastly, Consumer Discretionary exposure is about equal across the different market sizes and amounts to about 10%-11% of all three indexes.

One could argue that the smaller the market cap index, the better representation of the overall U.S. economy, as it contains more Industrials, Financials, and Consumer Discretionary companies. Therefore, if stocks in these sectors continue to perform better than other sectors next year, the small and mid-cap indices could continue to outperform their larger index counterpart.

Financial Services — Top-Performing Sector Over the Past Year

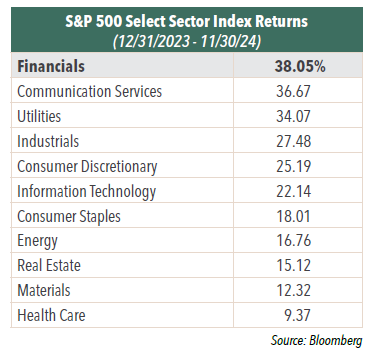

Although Financial services companies have been unloved for many years, the sector has seen a resurgence. Year-to-date through November 30, 2024, Financials was the top-performing sector in the S&P 500.

We believe a few macro factors driving this strong performance include declining interest rates, a more normalized yield curve, which is no longer inverted, and improving credit conditions. Banks have built reserves but still have anemic loan demand—although many investors believe loan growth will improve. Finally, the earnings of many large banks have improved over the past year.

Looking ahead, with the change in presidential administration accompanied by potentially less regulation, we may see an increase in merger and acquisition transactions in the banking industry.

Federal Reserve Rate Cuts and the Consumer

With respect to interest rates, our outlook for the lowering of the fed funds rate is similar to consensus views. In addition to the rate cut in September, probability of the Federal Reserve lowering rates in December 2024 remains high, with three additional rate cuts potentially by 2026. Assuming these rate cuts, at the end of 2026, the terminal rate could be 3.5%-3.75%, higher than it has been in previous cycles. Regardless of the number of cuts, the Fed will likely proceed at a slow and steady pace, and not cut rates aggressively. The Fed will be closely monitoring inflation and employment as it seeks to stabilize prices and maximize employment.

With consumer spending comprising 70% of U.S. GDP, the health of the consumer remains important. Wage growth has been positive, generally keeping up with inflation, and consumer confidence continues to remain strong. In November, U.S. consumer sentiment ticked up for a fourth straight month. However, we need to keep an eye on some anecdotal measures such as slowing transactions at discount stores and credit card delinquency rates, which can be signs of a deteriorating financial situation for the lower-end consumer.

AI Propels Power Demand

AI requires significantly more power relative to conventional central processing units (CPUs) and should continue to drive meaningful growth in electric power demand. Specifically, electricity demand is expected to grow about 2% per year, on average, until the end of the next decade. While this growth appears modest, it has historically been flat over the past 15 years.

Currently, roughly two thirds of the power grid uses electricity generated from natural gas and, to a much lesser extent, coal, with the remaining third from nuclear and renewable energy sources such as wind and solar. While renewables will likely continue to grow at a faster pace, natural gas will likely continue to be the go-to fuel on a near-term basis for reliable, steady, and affordable power generation. Therefore, this continuous increase in power demand should benefit natural gas distribution companies in addition to the power sector.

In addition, there will likely be downstream effects of AI that could benefit a larger group of companies, especially those trading at lower valuations compared to the overall market. Many of these companies will be using AI to reduce costs and increase productivity, which should boost their stock prices.

The Changing Sustainability Landscape

The ESG (Environmental, Social, and Corporate Governance) investment landscape has evolved significantly over the past few years. Sustainability has become a larger topic both on the corporate side and investor side. Some companies involved in utilities, energy, or industrials are going to generally be larger carbon emitters. We believe some companies that are leaders in this regard view sustainability as an opportunity. They understand that if they embrace a transition to a lower carbon economy, develop more sustainable products and services, they may be able to increase their prices, attract talented employees, and retain customers. On the investor side, there are many investors who believe that climate risk translates to portfolio risk, and they are acting in a fiduciary manner by adjusting client portfolios.

A Bullish Case for Japan

The Japanese equity market has always included high-quality companies, but now a confluence of macro factors have made the portfolio managers of the Hennessy Japan Fund and the Hennessy Japan Small Cap Fund even more bullish.

Government initiatives have encouraged companies to become more shareholder friendly. For example, the Tokyo Stock Exchange introduced a “name and shame” initiative to drive better governance and higher valuations from companies that had a price to book ratio below 1x.

We believe these corporate governance improvements are the single biggest driver of stock performance regardless of political leadership and economic developments. Other positive factors for Japanese equities include:

• Negative real interest rates. Japan is the only currency among the major economies with negative real interest rates. With CPI at approximately 2% and the 10-year yield at less than 1%, real rates continue to be negative. However, with a bump in yields, Japan may be heading back to positive real interest rates, which would be beneficial to the struggling yen.

• Accommodative rate policy. We believe the Bank of Japan will continue to seek a normalization of interest rates. However, it will likely be executed in a gradual manner to avoid past experiences. For example, in 2006-2007, the central bank prematurely lifted the zero-rate policy causing the economy to revert to a deflationary environment. As a result, the overall monetary policy will likely remain accommodative.

• Persistent inflation. While there was no inflation in Japan for many years, the 2%current inflation rate should drive additional growth, which we believe will result in a higher return on equity and higher stock prices.

• Wage inflation. While real wage growth in Japan has remained flat since the early 90s, we are seeing noticeable increases over the past two years. Wage growth was 3.6% in 2023 and 5.1% in 2024—exceeding the 5% level for the first time in 33 years.

• Japanese investors. Japan has $15 trillion in liquid household financial assets and half of that amount is in bank accounts earning little to no interest. The second iteration of the individual savings account was introduced earlier this year to encourage investors in Japan to open new brokerage accounts and invest in the market.

When it comes to small-cap investing in Japan, we believe there are ample attractive investment opportunities in undervalued, high-quality companies that active managers can uncover. In Japan, there is a large information gap as only 30% of companies are covered by research analysts. Over the past 30 years, SPARX Asset Management, sub-advisor to the Hennessy Japan and Japan Small Cap Funds, has a deep understanding of corporate Japan and employs a research-intensive investment process to uncover these opportunities.

The Benefits of Long-Term, Disciplined Investing

At Hennessy Funds, we are long-term, active investors. Both our internal portfolio managers and our sub advisors stay true to their “north star” and try not to be influenced by short-term trends and market noise. One example is the investment process driving the Hennessy Focus Fund. The Portfolio Managers employ independent, fundamental research, with a focus on five key investment criteria: high-quality business, large growth opportunity, excellent management, low “tail risk,” and discount valuation. They believe stocks that meet these stringent criteria have the potential to produce a sustained mid-teens or higher rate of earnings growth over a period of years.

Being an active investor also requires discipline. The Hennessy Cornerstone funds offer a way to remain disciplined without emotions getting in the way. Each strategy maintains a repeatable investment process, selecting stocks based on strict criteria, and the portfolio remains invested over a one-year period.

Looking ahead, investing may require more patience and discipline with anticipated volatility. The Dow Jones Industrial Average is often referenced by the financial media and therefore is an often-used gauge for market performance. With Nvidia as a new constituent, Information Technology stocks now comprise a larger portion of the Dow along with Apple, Microsoft, and Salesforce. If these stocks rise and fall together like they have in the past, they could cause the Dow to be more volatile. We believe this increased volatility is positive for active managers who can take advantage of dips in the market to invest at attractive prices.

Regardless of the direction of the markets, all of the Portfolio Managers at the Hennessy Funds encourage investors to consider their long-term goals and maintain a diversified portfolio.

- In this article:

- Overall Market

- Cornerstone Growth Fund

- Focus Fund

- Cornerstone Mid Cap 30 Fund

- Cornerstone Large Growth Fund

- Cornerstone Value Fund

- Total Return Fund

- Equity and Income Fund

- Balanced Fund

- Energy Transition Fund

- Midstream Fund

- Gas Utility Fund

- Japan Fund

- Japan Small Cap Fund

- Large Cap Financial Fund

- Small Cap Financial Fund

- Japan Fund

You might also like

-

Market Outlook

Market OutlookCIO Outlook: After Two Remarkable Market Years, What’s Next for Stocks?

Ryan C. Kelley, CFAChief Investment Officer and Portfolio ManagerRead the Commentary

Ryan C. Kelley, CFAChief Investment Officer and Portfolio ManagerRead the CommentaryRyan Kelley, Chief Investment Officer, discusses potential market volatility, opportunities in specific sectors like financials and energy, potential growth in small and mid-cap stocks and why a diversified approach is key.

-

Market Outlook

Market OutlookCIO Mid-year Review: Market Highs, Uncertainties & Opportunities

Ryan C. Kelley, CFAChief Investment Officer and Portfolio ManagerRead the Commentary

Ryan C. Kelley, CFAChief Investment Officer and Portfolio ManagerRead the CommentaryRyan Kelly, CIO of Hennessy Funds reflects on the first half of 2024, marked by robust performance across all major indexes and provides his outlook on the U.S. market in a period of uncertainty and volatility.

-

Market Outlook

Market OutlookMarket Myopia: Tough Beginnings & Fantastic Finishes

Ryan C. Kelley, CFAChief Investment Officer and Portfolio ManagerRead the Commentary

Ryan C. Kelley, CFAChief Investment Officer and Portfolio ManagerRead the CommentaryChief Investment Officer, Ryan Kelley, describes "market myopia" and the eight technology giants' effect on returns in 2023. He reinforces that time in the market and staying mindful of downside risk remains relevant and he believes the outlook for U.S. stocks remains positive.