Driven by Revenues, Cash Flow, and High Dividend Yields

In the following commentary, the Portfolio Managers of the Hennessy Cornerstone Value Fund discuss the Fund’s formula-based investment strategy and how it drives the Fund’s sector and industry positioning.

-

Neil J. HennessyChief Market Strategist and Portfolio Manager

Neil J. HennessyChief Market Strategist and Portfolio Manager -

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager -

L. Joshua Wein, CAIAPortfolio Manager

L. Joshua Wein, CAIAPortfolio Manager

What is the Hennessy Cornerstone Value Fund’s investment strategy?

The Fund utilizes a formula-based approach to build a portfolio of potentially undervalued, profitable, large-cap companies. From the universe of stocks in the S&P Capital IQ Database (excluding utilities), the Fund selects 50 stocks with the highest dividend yield that also meet the following criteria:

» Above-average market capitalization

» Above-average number of shares outstanding

» Trailing 12-month sales 50% greater than average

» Above-average cash flow

Why does the Fund use these screening criteria?

These criteria help the Fund find companies that are large, profitable, and able to pay a healthy dividend. Large market capitalization companies tend to be well-established leaders in their industries with long, successful track records and solid profitability.

A large revenue base is often associated with companies that have a high share of their market or that have diversified successfully.

Above average cash flow identifies companies with strongly profitable business models, possibly generating excess cash flow which may be returned to shareholders in the form of a dividend.

Why does the formula select stocks with the highest dividend yield?

From among the companies that meet the screening criteria, the Fund selects the 50 with the highest dividend yield. As high dividend yield can be a good indicator of a low stock valuation, this helps uncover potentially undervalued companies.

How does the Fund seek to provide a return to investors?

We believe the combination of profitability and value offers investors an opportunity to earn a return in two ways. In our view, the Fund’s investments offer the potential for capital appreciation if and when market sentiment changes and their valuations rise. Investors in the Fund are also “paid to wait,” potentially rewarded with a steady income stream from dividends.

How often does the Fund rebalance its portfolio?

The universe of stocks is re-screened and the portfolio is rebalanced annually, generally in the winter. Holdings are weighted equally by dollar amount with approximately 2% of the Fund’s assets invested in each during the rebalance.

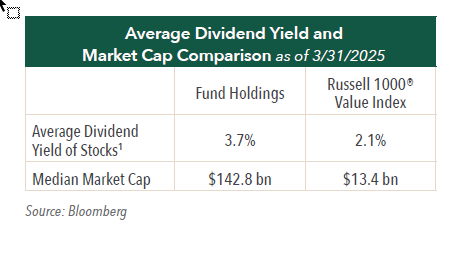

How does the Fund’s portfolio differ from its benchmark?

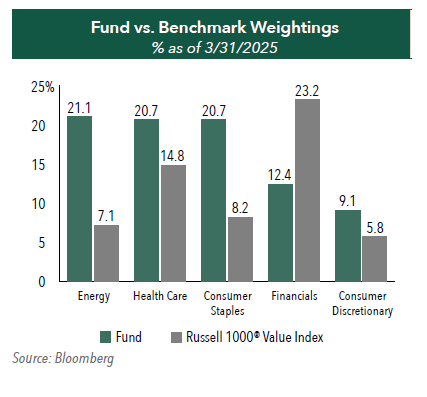

Compared to its benchmark, the Russell 1000® Value Index, the Fund is most significantly overweight the Energy, Healthcare and Consumer Staples sectors. The Fund’s largest sector weightings include the three overweight sectors mentioned above as well as Financials, all of which are over 10% of the portfolio as of March 31, 2025. Of note, the Fund has no exposure to Materials, Real Estate or Utilities, each of which comprise less than 5% of the benchmark.

The Fund’s Energy exposure would benefit from higher commodity prices if we see increasing demand in 2025, which would be driven improvements in domestic and global economies. With holdings primarily in large, integrated oil & gas conglomerates, the Fund could benefit from higher cash flows, higher profitability, and benefits to shareholders through dividends, share repurchases, and the reduction of higher costing debt.

The Fund has significant positions in Health Care stocks, primarily large pharmaceutical companies, which typically pay attractive dividends when the sector is out of favor. Although Health Care stocks have underperformed the overall market for the past several years, Health Care continues to be a significant portion of the overall Fund, which is typical both for this fund as well as many other largecap value funds.

In the case of Consumer Staples, the Fund has holdings in soft drinks, packaged foods, tobacco, and other personal and household products. These stocks tend to pay consistent and strong dividends, and we typically see high representation from this sector in the Fund.

- In this article:

- Domestic Equity

- Cornerstone Value Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Cornerstone Large Growth FundHigh Profitability and Attractive Valuations – A Compelling Combination

Neil J. HennessyChief Market Strategist and Portfolio Manager

Neil J. HennessyChief Market Strategist and Portfolio Manager Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryIn the following commentary, the Portfolio Managers of the Hennessy Cornerstone Large Growth Fund discuss the Fund’s formula-based investment process and how it drives the Fund’s sector and industry positioning.

-

Portfolio Perspective

Portfolio Perspective

Focus FundLong-term Investing in a Concentrated Collection of Businesses

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Commentary

Brian Macauley, CFACo-Portfolio ManagerRead the CommentaryIn the following commentary, the Portfolio Managers of the Hennessy Focus Fund summarize the 2024 market and provide their insights on their 2025 outlook, including the impact on holdings from presidential administration’s policy changes and the growth of AI.

-

Viewpoint

ViewpointHidden Gems: The Hennessy Cornerstone Mid Cap 30

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager L. Joshua Wein, CAIAPortfolio ManagerWatch the Video

L. Joshua Wein, CAIAPortfolio ManagerWatch the VideoLearn more about the Hennessy Cornerstone Mid Cap 30 Fund, a top-performing strategy that uses a transparent, consistent, disciplined approach to identify undervalued mid and small-cap companies. Portfolio Managers Ryan Kelly and Josh Wein explain their time-tested formula and discuss why it consistently outperforms the market.