A Comprehensive Market Overview and Update On the Fund's Positioning

In the following commentary, the Portfolio Managers of the actively managed Hennessy Equity and Income Fund (HEIFX/HEIIX) share their perspective on the equity and fixed income markets, a new equity holding, where on the yield curve they are finding opportunity, and their outlook for the remainder of 2024.

-

Stephen M. Goddard, CFAPortfolio Manager

Stephen M. Goddard, CFAPortfolio Manager -

Gary B. Cloud, CFAPortfolio Manager

Gary B. Cloud, CFAPortfolio Manager -

Mark E. DeVaul, CFA, CPAPortfolio Manager

Mark E. DeVaul, CFA, CPAPortfolio Manager -

J. Brian Campbell, CFAPortfolio Manager

J. Brian Campbell, CFAPortfolio Manager -

Peter G. Greig, CFAPortfolio Manager

Peter G. Greig, CFAPortfolio Manager -

Samuel D. Hutchings, CFAPortfolio Manager

Samuel D. Hutchings, CFAPortfolio Manager

Equity Allocation

Would you please share your perspective on the concentration of market performance in the first half of 2024?

Market performance in the first six months of 2024 was incredibly narrow with only 26% of stocks in the S&P 500 Index outperforming the overall Index—extremely low by historical standards. As a result, the top 10 S&P 500 companies by market capitalization now comprise nearly 40% of the Index. Those stocks were responsible for 70% of the year-to-date Index return. By comparison, the return contribution of the top 10 companies in the Index was higher than what we saw in 1999 during the tech bubble.

Would you describe a new holding that exemplifies your investment process?

We purchased TE Connectivity, which is a play on the continued electrification of things and fits our process well. TE sells mission-critical, low-cost interconnect solutions with long-term secular growth potential due to electrification. Its largest markets are in the automotive space where the electrification of cars is leading to twice the level of revenue potential compared to internal combustion engine vehicles.

TE may also benefit from continued Industrial Electrification and data center build outs. We have been impressed with management’s ability to increase operating margins, which have expanded by over 500 basis points since its divestiture from Tyco International in 2007.

The company also generates strong free cash flow and has returned two-thirds of that cash flow to shareholders over time. The company has strong double-digit return on invested capital, healthy operating margins, and limited net debt at less than 1x net debt to EBITDA. We believe the stock is trading at over a 20% discount to our estimate of intrinsic value.

Would you please discuss the Fund’s equity valuation and composition relative to the S&P 500?

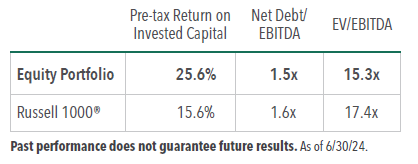

As of mid-year 2024, we believe the portfolio offered higher quality companies with less debt and a lower valuation relative to the overall market. This composition has historically been bullish for long-term investors.

Where are you finding current opportunities in today’s market?

We believe better opportunities exist in areas of the market that are outside of the artificial intelligence (AI) plays, including the following holdings:

- Norfolk Southern. Industrials and railroads have been out of favor over the past few years. The company also fell out of favor due to the train derailment in Ohio in 2023. With a second line open again, the company should benefit from improved throughput, and raise prices.

- Air Products & Chemicals, an industrial gas company that operates in an oligopolistic industry with strong pricing power and stable long-term contracts. We took advantage of recent weakness in the stock to add to our position. We believe shares are now trading at a steep discount to its closest competitor, which appears unjustified.

What is your equity outlook for the remainder of 2024?

In terms of the equity market, valuations based on near-term earnings are elevated in the context of moderate GDP growth. We believe that equity returns in the near term may be modest, with shareholder yield (dividends, share repurchase, debt reduction) comprising a significant percentage of the total return from equities.

Longer term, we believe quality attributes and solid company fundamentals will lead to strong risk-adjusted returns. We believe our equity holdings in the Fund generate sustainably high returns on capital, with low leverage ratios, and sell at reasonable valuations relative to the broader market. Importantly, quality metrics typically outperform in the years following peak rates, so if we do see a cut in rates the Fund’s equity holdings could benefit. The equity portfolio would also benefit from a broadening of returns in the market.

Fixed Income Allocation

How do you expect the Federal Reserve to proceed from an interest rate perspective over the next 6-12 months?

At the beginning of the year, the market expected up to six interest rate cuts but by mid-year, the number had decreased to just one. Following the inflation and unemployment data in July, we have revised our viewpoint. Our thinking is now more in line with the market, which is expecting two rate cuts this year—one in September or November, and one in December. Over the next 12 months beginning in September, there could be five rate cuts in total.

What are your views on government bonds, investment grade corporate debt and high yield securities?

The fixed income portion of the portfolio, which comprises 30% of the Fund, currently has no exposure to high yield securities primarily because current credit spreads have been narrow indicating that investors have not been compensated for the increased risk. In addition, investment grade debt appears relatively more attractive as it is offering higher yields today compared to prior years.

In terms of credit quality, 56% of the fixed income portfolio is comprised of Aaa/AAA rated bonds, 19% is in A rated bonds, and 25% in Baa/BBB rated bonds as of June 30, 2024.

Where along the yield curve are you finding opportunity?

We are fairly neutral on the yield curve with the Fund having a similar maturity profile as the Bloomberg Capital Intermediate U.S. Government/Credit Index. When rate cuts begin in earnest, we may see a larger decline on front end of the curve, meaning short-term rates could fall further than long-term rates.

When credit spreads are tight, it is difficult to find opportunities. Using our proprietary tools, we assess the relative value of specific securities across sectors, ratings, and historical corporate curves. Our analysis shows that most corporate curves are relatively flat, which is common in a tight spread environment.

With the current inverted yield curve for corporate credits, we are focused on those that are higher quality and have relatively short maturities.

What is your fixed income outlook for the remainder of the year?

We are in the early stages of an easing cycle which is expected to begin toward the end of 2024. It is our belief that short-term rates could decline more than longer rates. As we move into next year, we should see the curve flatten or uninvert, and then eventually steepen.

Importantly for fixed income investors, it is an election year, which will bring uncertainty policy-wise due to different approaches of each administration.

- In this article:

- Multi Asset

- Equity and Income Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Equity and Income FundAn Opportunistic Balance of High-Quality Stocks and Investment Grade Bonds

Stephen M. Goddard, CFAPortfolio Manager

Stephen M. Goddard, CFAPortfolio Manager Samuel D. Hutchings, CFAPortfolio Manager

Samuel D. Hutchings, CFAPortfolio Manager Gary B. Cloud, CFAPortfolio Manager

Gary B. Cloud, CFAPortfolio Manager Peter G. Greig, CFAPortfolio ManagerRead the Commentary

Peter G. Greig, CFAPortfolio ManagerRead the CommentaryIn the following commentary, the Portfolio Managers of the actively managed Hennessy Equity and Income Fund provide their perspective on investing in high-quality companies and investment grade bonds in 2025.

-

Portfolio Perspective

Portfolio Perspective

Equity and Income FundIdentifying 2024 Opportunities in Equities and Fixed Income

Samuel D. Hutchings, CFAPortfolio Manager

Samuel D. Hutchings, CFAPortfolio Manager Gary B. Cloud, CFAPortfolio Manager

Gary B. Cloud, CFAPortfolio Manager Peter G. Greig, CFAPortfolio ManagerRead the Commentary

Peter G. Greig, CFAPortfolio ManagerRead the CommentaryPortfolio Managers of the actively managed Hennessy Equity and Income Fund (HEIFX/HEIIX) discuss the attractiveness of higher-quality value companies, how the current environment favors active management, the Federal Reserve’s plan to cut rates, and how the fixed income portfolio is positioned.

-

Viewpoint

ViewpointViewpoints by Hennessy - Sam Hutchings and Peter Greig

Samuel D. Hutchings, CFAPortfolio Manager

Samuel D. Hutchings, CFAPortfolio Manager Peter G. Greig, CFAPortfolio ManagerWatch the Video

Peter G. Greig, CFAPortfolio ManagerWatch the VideoOn this episode of Viewpoints by Hennessy, Sam Hutchings & Peter Greig, Portfolio Managers of the Hennessy Equity & Income Fund, talk with Jay Coulter about the Hennessy equity investment process and fixed income investing, and discuss the investment cases for some key individual holdings.