An Opportunistic Balance of High-Quality Stocks and Investment Grade Bonds

In the following commentary, the Portfolio Managers of the actively managed Hennessy Equity and Income Fund provide their perspective on investing in high-quality companies and investment grade bonds in 2025.

-

Stephen M. Goddard, CFAPortfolio Manager

Stephen M. Goddard, CFAPortfolio Manager -

Samuel D. Hutchings, CFAPortfolio Manager

Samuel D. Hutchings, CFAPortfolio Manager -

Gary B. Cloud, CFAPortfolio Manager

Gary B. Cloud, CFAPortfolio Manager -

Peter G. Greig, CFAPortfolio Manager

Peter G. Greig, CFAPortfolio Manager

Key Takeaways

EQUITY

» After two years of 20%+ returns, the S&P 500 Index is highly concentrated and trades at historically elevated levels.

» The Fund focuses on high-quality companies with strong competitive advantages and pricing power. If costs increase due to the proposed tariffs, many equity holdings have pricing power to pass the increase to their customers.

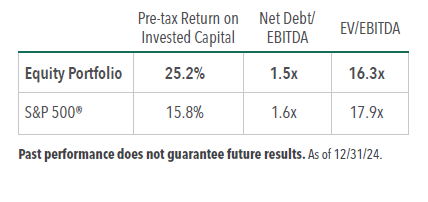

» As of the beginning of 2025, the Fund’s equity portion, on average, had higher returns on invested capital, less leverage and traded at a lower valuation compared to the overall market.

FIXED INCOME

» The Fed will likely continue to lower the fed fund rate in 2025 unless there is a reversal in inflation.

» In 2024, the market saw the second-highest level of new corporate bond issuance ever in 2024.

» The steepening and positive yield curve creates opportunities for the Fund to extend maturities and lock in yields over a longer time frame.

Equity Portfolio

Would you please comment on the strong equity market in 2024?

Last year’s S&P 500® Index returns of +20% mirror those in 2023, and together produced the strongest two-year period for the market since the late 1990s. Two +20% sequential years has only happened previously five times for the S&P 500.

The narrowness of the 2024 market also resembles the 1990s tech bubble, where a handful of names drove most of the Index’s return.

As a result, the S&P 500 is currently highly concentrated, with the top 10 stocks representing over 30% of the Index’s weighting. In addition, the Index is trading at historically elevated levels at 22x 2025 forward earnings.

With that in mind, we believe investors should be aware of the concentration risks and the valuation risks in certain equities today.

With growth stocks outperforming value companies in 2024, what could cause this trend to change?

One of the reasons growth stocks have done so well is because U.S. GDP been fairly muted and investors have rewarded growth names due to their scarcity value. If artificial intelligence developments (AI) significantly increase productivity, earnings growth could broaden, which should be positive for companies trading at inexpensive valuations compared to their more expensive peers.

In addition, if there is a negative shock to the economy or the market declines over an extended period, investors could start to select companies based on attractive valuations.

Finally, if AI demand does not meet expectations, a handful of companies could disproportionately fall in share price because their current valuations are baking in very high expectations.

How could the new administration’s tariff policies either help or hurt your portfolio holdings?

During President Trump’s first term, a series of tariffs were imposed that are still in place today, and our companies were able to adapt. Therefore, we would expect the impact of any new tariffs to be fairly benign for the portfolio.

For the equity part of the portfolio, we focus on high-quality companies with strong competitive advantages. Many of our holdings have strong pricing power so if costs increase, these companies are typically in a position to pass the increased costs to the end customer.

For example, Home Depot and Lowe’s, portfolio holdings in the Fund, source products from around the world and historically have been successful in offsetting cost increases by raising price and moving supply chains to lower cost jurisdictions.

Insomuch as tariffs are inflationary, a company such as Visa that facilitates transactions around the world could perform well because a portion of its revenues is from the total dollar volume of credit card usage. Any inflationary pressures therefore increase overall credit card spend.

Would you please discuss a new position in the Fund?

We purchased Bruker Corporation in the fourth quarter of 2024. Bruker creates scientific instruments used to detect, measure, and visualize the characteristics of chemical, biological, and industrial materials. Essentially, the company sells high-value machines often found in academic and government settings.

The stock sold off more than 40% this year on concerns we believe are short-term in nature and focused on both Chinese market and biopharma demand.

Bruker has a leading market share in most areas where it conducts business. We believe the company is well positioned to benefit from secular growth drivers in innovative science discovery. In addition, we were attracted to how well diversified its business is across geographies, end markets, and applications.

Bruker has historically had strong returns on capital in the 20% range and it is a founder-led firm with the CEO owning greater than 25% of outstanding shares.

After a market of 20%+ returns for the past two years, what are your thoughts for equity investors?

Given the strength in the market over the last two years, historically high valuations and large concentration risks, investors could see more muted returns going forward. With elevated valuations, we believe equity performance could come more from earnings growth and shareholder returns via dividends and buybacks.

With this backdrop, it may be advantageous to focus on high-quality companies with sustainable competitive advantages, durable earnings streams and free cash flow that can, in effect, return capital to shareholders.

Based on the metrics shown in the table below, the Fund entered 2025 with what we believe to be quality attributes and solid company fundamentals. The equity portion of the portfolio, on average, had higher returns on invested capital and less leverage and traded at a lower valuation relative to the overall market.

Fixed Income Portfolio

What is your perspective on Federal Reserve cuts in 2025?

The Fed suggested at its December meeting that there could be two rate cuts in 2025. These cuts follow a 50-basis point reduction in September, and two 25-basis-point cuts in November and December 2024. The market has only priced in one to two rate cuts in 2025, with which we would agree. Importantly, the Fed wants to keep on a path of lowering rates unless inflation rises once again.

Would you please discuss relative spreads across the investment grade and high yield market?

Currently, high yield and investment grade spreads are narrow relative to history. We see solid fixed income demand because yields across the yield curve are higher than they have been in years. Investment flows into fixed income through mutual funds and ETFs have been strong, allowing credit spreads to tighten.

Corporate bond supply increased as well, as the market saw the second-highest level of new corporate bond issuance ever in 2024. Last year, companies issued over $1.5 trillion in bonds, the level of which was second only to 2020 when there was a pandemic-fueled burst of issuance as corporations sought to bolster their capital position and cash reserves.

We still believe there is good value in high-quality corporate bonds, and as a result, the Fund has a higher allocation to corporate bonds than the Bloomberg Intermediate Government/Credit Index.

Conversely, the Fund’s income portion of the portfolio has no current exposure to the high yield market as we do not believe investors are being paid adequately to assume the higher credit risk.

Would you please discuss the yield curve?

The spread between the 2-year and 10-year Treasury yields are back in positive territory, which we have not seen in a few years with the inverted yield curve. As of the beginning of 2025, there was almost a 40 basis points spread between the 2-year Treasury and the 10-year Treasury. That compares to the past two years with higher short-term Treasuries rates than longer- term Treasuries.

The steepening and positive curve creates opportunities for the Fund to extend maturities and lock in yields over a longer time frame.

- In this article:

- Multi Asset

- Equity and Income Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Equity and Income FundA Comprehensive Market Overview and Update On the Fund's Positioning

Stephen M. Goddard, CFAPortfolio Manager

Stephen M. Goddard, CFAPortfolio Manager Gary B. Cloud, CFAPortfolio Manager

Gary B. Cloud, CFAPortfolio Manager Mark E. DeVaul, CFA, CPAPortfolio Manager

Mark E. DeVaul, CFA, CPAPortfolio Manager J. Brian Campbell, CFAPortfolio Manager

J. Brian Campbell, CFAPortfolio Manager Peter G. Greig, CFAPortfolio Manager

Peter G. Greig, CFAPortfolio Manager Samuel D. Hutchings, CFAPortfolio ManagerRead the Commentary

Samuel D. Hutchings, CFAPortfolio ManagerRead the CommentaryIn the following commentary, the Portfolio Managers of the actively managed Hennessy Equity and Income Fund (HEIFX/HEIIX) share their perspective on the equity and fixed income markets, a new equity holding, where on the yield curve they are finding opportunity, and their outlook for the remainder of 2024.

-

Portfolio Perspective

Portfolio Perspective

Equity and Income FundIdentifying 2024 Opportunities in Equities and Fixed Income

Samuel D. Hutchings, CFAPortfolio Manager

Samuel D. Hutchings, CFAPortfolio Manager Gary B. Cloud, CFAPortfolio Manager

Gary B. Cloud, CFAPortfolio Manager Peter G. Greig, CFAPortfolio ManagerRead the Commentary

Peter G. Greig, CFAPortfolio ManagerRead the CommentaryPortfolio Managers of the actively managed Hennessy Equity and Income Fund (HEIFX/HEIIX) discuss the attractiveness of higher-quality value companies, how the current environment favors active management, the Federal Reserve’s plan to cut rates, and how the fixed income portfolio is positioned.

-

Viewpoint

ViewpointViewpoints by Hennessy - Sam Hutchings and Peter Greig

Samuel D. Hutchings, CFAPortfolio Manager

Samuel D. Hutchings, CFAPortfolio Manager Peter G. Greig, CFAPortfolio ManagerWatch the Video

Peter G. Greig, CFAPortfolio ManagerWatch the VideoOn this episode of Viewpoints by Hennessy, Sam Hutchings & Peter Greig, Portfolio Managers of the Hennessy Equity & Income Fund, talk with Jay Coulter about the Hennessy equity investment process and fixed income investing, and discuss the investment cases for some key individual holdings.