Japan: Land of Opportunity Potential

With welcomed levels of inflation, a weak currency and an accommodative central bank, Japan is attracting considerable investor attention. The Portfolio Management team discusses their thoughts on interest rate direction, wage increases, record levels of tourism, and how the Fund is positioned to benefit in this economic environment.

-

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager -

Angus Lee, CFAPortfolio Manager

Angus Lee, CFAPortfolio Manager

What are your thoughts on the Bank of Japan raising benchmark rates earlier this year?

In March 2024, the central bank raised interest rates for the first time in 17 years. The overnight core rate went from -10 basis points to +10 bps, although when accounting for inflation, real short- and long-term interest rates remain in negative territory.

We believe in the face of welcomed levels of sustained inflation, the Bank of Japan will plan on continuing to raise rates. However, it will likely be executed in a gradual manner to avoid past experiences. For example, in 2006-2007, the central bank prematurely lifted the zero-rate policy causing the economy to revert to a deflationary environment. Now officials will likely err on the side of higher relative inflation before implementing a series of rate hikes. As a result, the overall monetary policy will likely remain accommodative.

What is your perspective on the Japanese yen?

With an exchange rate of 161 yen to dollar in early July 2024, the Japanese yen is historically inexpensive compared to the U.S. dollar. Also, the yen is the only currency among the major advanced economies with negative real interest rates, which means currency wise, the Japanese yen is less favored than other countries’ currencies.

The current economics dictate that the Japanese yen will likely stay relatively inexpensive, and in this environment, we believe the best way to invest in Japan is in high-quality, global Japanese companies with significant overseas revenues.

How is the weak yen driving tourism in Japan?

In 2019, international visitor arrivals to Japan nearly reached a record 32 million, and in 2024, tourism is on track to reach 36 million visitors. Historically each tourist spent $1,200 to $1,500 per visit, cumulatively contributing approximately 1% to GDP. Now, with the depreciation of the Japanese yen, tourists have 30-40% more purchasing power. Therefore, they could spend more in the services and hospitality industries.

We believe Japan can accommodate even more inbound tourists in the coming years. For example, Spain and France average 80-90 million visitors per year; 40-45 million tourists annually visit Thailand. We are confident that Japan can continue to enjoy this higher level of tourism, incrementally adding to the country’s GDP.

Why do you believe wages will continue rising in Japan?

Currently, Japan has 65 million workers which is expected to decline over time even with the rehiring of seniors and increasing participation of women in the workforce.

Last year after the spring wage negotiation season, wage increases averaged 3.6%, which was the biggest increase since the early 1990s. This year, wage increases on average rose 5.1%, exceeding the 5% level for the first time in 33 years.

Real wage growth is still underwater because of higher-than-expected inflation. We believe companies are becoming more supportive in terms of giving more pay raises to help employees cope with the higher levels of inflation. With this year’s wage hikes, we anticipate Japan’s real wage growth turning positive in the second half of 2024 or in 2025.

What changes have been made to the Fund in the face of higher inflation and higher rates?

We believe in an environment with a weak yen and negative real interest rates, Japanese global companies that have a significant amount of overseas revenues look particularly attractive. The Hennessy Japan Fund holds many companies we have dubbed to be “growth stocks in disguise.” These companies have compelling growth prospects, yet the stock appears to be undervalued. Some examples include:

• Japanese non-life insurance companies that include Tokio Marine Holdings, SOMPO Holdings, and MS&AD insurance Group, which control nearly 90% of the domestic underwriting business.

• ORIX, Japan’s largest non-bank, comprehensive financial services company.

• Mitsubishi UFJ Financial Group, one of the three largest mega-banks in Japan.

• Mitsubishi Corporation, the largest trading company in Japan.

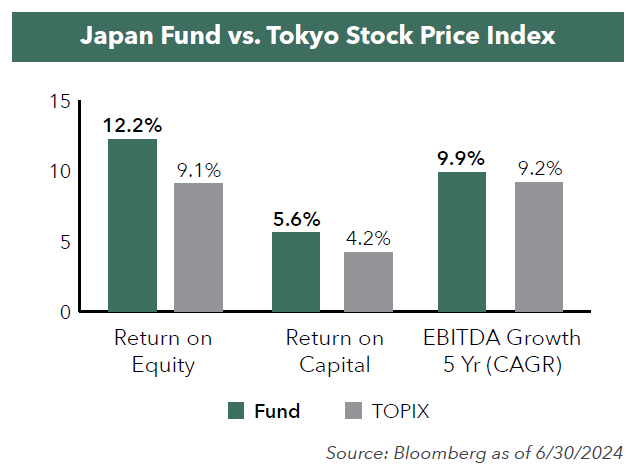

As a result of this focus, the Fund’s portfolio companies have exhibited impressive long-term growth rates, high returns on capital, and superior returns on equity compared to the Tokyo Stock Index Price Index (TOPIX). The Fund’s companies generally have strong operating “moats” and positive long-term economic characteristics, including network effects and economies of scale.

What are current valuations of Japanese stocks compared to those in the U.S.?

We believe Japanese stocks look relatively attractive compared to companies in the U.S. As of the end of the second quarter in 2024, the price-to-earnings (P/E) and price-to-book (P/B) for the TOPIX was 14.7x and 1.5x, respectively. These metrics compare favorably to the S&P 500 Index, which had a P/E and P/B of nearly 20x and almost 5x as of the same date.

- In this article:

- Japan

- Japan Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Japan FundJapan’s Evolving Investment Landscape in 2025

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio ManagerRead the Commentary

Angus Lee, CFAPortfolio ManagerRead the CommentaryIn the following commentary, the Hennessy Japan Fund Portfolio Managers summarized what most surprised them in 2024 about the Japanese market along with positive trends driving Japanese companies.

-

Portfolio Perspective

Portfolio Perspective

Japan Small Cap FundJapanese Small-Caps: Attractive Valuations with Potential for Sustained Growth

Takenari Okumura, CMAPortfolio Manager

Takenari Okumura, CMAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the Commentary

Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the CommentaryThe Portfolio Managers summarize the 2024 Japanese market and discuss the compelling opportunities they are finding in undervalued Japanese small-cap companies.

-

Investment Idea

Investment IdeaCompelling Valuations in Japan

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio Manager

Tadahiro Fujimura, CFA, CMAPortfolio Manager Takenari Okumura, CMAPortfolio ManagerRead the Investment Idea

Takenari Okumura, CMAPortfolio ManagerRead the Investment IdeaJapanese equities are currently trading at compelling valuation levels compared to other developed equity markets around the world and relative to their own historical averages. We believe the Japanese market deserves a closer look.