Tailwinds for Japanese Small Companies

The Portfolio Managers discuss the drivers creating a more favorable business environment for Japanese small-cap companies.

-

Takenari Okumura, CMAPortfolio Manager

Takenari Okumura, CMAPortfolio Manager -

Tadahiro Fujimura, CFA, CMAPortfolio Manager

Tadahiro Fujimura, CFA, CMAPortfolio Manager

Key Takeaways

» Japanese small-cap stocks appear undervalued relative to history and to large-cap stocks.

» The depreciation of the yen has increased costs for Japanese small-caps, creating headwinds. However, rising wages and stabilizing inflation may improve their growth prospects.

» Japan’s inflation is expected to stabilize around 2%, creating a favorable business environment for small-cap companies with pricing power. This virtuous cycle between wage and price growth provides opportunities for companies to pass on costs and enhance profitability.

» Tailwinds for small-cap stocks include Japan’s economic recovery, progress in corporate governance, and rising wages. Domestic demand-focused small caps are particularly well-positioned to benefit from these trends.

How do current valuations of Japanese small-cap stocks compare to historical averages?

We believe Japanese small-cap stocks are currently significantly undervalued. In particular, when compared to large-cap stocks, they appear to be at their most attractive levels in over a decade. Given the strong growth potential of small caps, it seems the market has largely overlooked them.

Small caps have lagged behind large caps, weighed down by factors such as the rapid Japanese yen depreciation, which drove up input costs, and

the slower-than-expected recovery in domestic consumption. However, looking ahead, we expect small-cap performance to rebound as the domestic economy benefits from steady inflation, sustained wage growth, and a virtuous cycle of earnings growth. These factors should support a recovery in small-cap valuations and bring attention back to this underappreciated segment of the market.

How have currency movements impacted Japanese small-cap stocks this year?

Yen depreciation has generally created a headwind for small-cap stocks with a strong domestic focus. The rapid weakening of the yen earlier this year pushed up import prices, placing upward pressure on expenses for many of these companies. However, with steady wage growth underway, real incomes are approaching a positive turning point, which could empower these companies to more effectively pass on costs to consumers. This shift will likely be a more favorable environment for price adjustments and potential margin recovery.

As inflation stabilizes and wages continue to rise, we expect an improved outlook for small-cap companies, particularly those focused on domestic demand. By leveraging their pricing power, we believe these companies are well positioned to manage costs and capitalize on the evolving economic landscape.

Would you please discuss what to expect from the new Prime Minister in terms of supporting Abenomics and the growth of the Japanese economy? What might his leadership mean for Japanese small-cap stocks moving forward?

First of all, we maintain a bullish outlook on the Japanese economy, expecting the positive cycle between wages and prices to continue. However, structural issues like population decline, aging society, and companies clinging to deflationary management practices remain. It’s important to selectively invest in companies that can adapt to these challenges. Corporate governance reforms will drive long-term growth, particularly for small and mid-cap stocks, where there is significant room for improvement in profitability. Domestic demand-driven companies also offer potential through consolidation and improved competition.

When Shigeru Ishiba was appointed as the new Prime Minister, the market was concerned about a potential shift in policies, given his position as a non-mainstream figure in the Liberal Democratic Party (LDP). The sharp drop in stock prices following the election reflected this. However, Ishiba’s subsequent commitment to maintaining the previous PM Kishida’s economic policies provided reassurance. Although slightly more hawkish than his predecessors, the independence of the Bank of Japan means the impact on monetary policy will likely be limited, with a gradual shift towards a neutral policy rate of 1-2%. Corporate earnings growth, supported by inflation and capital efficiency, should continue under a favorable currency environment and accommodative monetary policy. Corporate governance reforms will remain a significant driver of the Japanese stock market, initially spearheaded by the former PM Abe’s Abenomics and further propelled by pressure from both domestic and international activist investors.

Would you please discuss Japan’s persistent inflation level and its effect on smaller domestic companies?

Japan’s inflation dynamics are evolving in a way that presents rare opportunities for smaller domestic companies. While the initial cost pressures from rising import prices are starting to ease, wage increases are now driving a gradual rise in service prices, which is expected to stabilize inflation around 2%. This steady inflation is supported by structural factors in Japan, including a shrinking population and labor shortages, both of which are likely to sustain inflation over the long term.

We expect the virtuous cycle between wage growth and price increases to gain further momentum, creating a more favorable business environment. In our view, this backdrop is especially advantageous for smaller domestic companies with strong pricing power or differentiated, high-value offerings, as they are well-positioned to absorb higher costs and leverage the demand for quality. Companies that can pass on costs effectively or enhance their value proposition are likely to see accelerated growth in this climate, benefiting from a tailwind of sustained inflation.

How have corporate governance reforms and incentives have benefitted Japanese small caps? Would you provide an example?

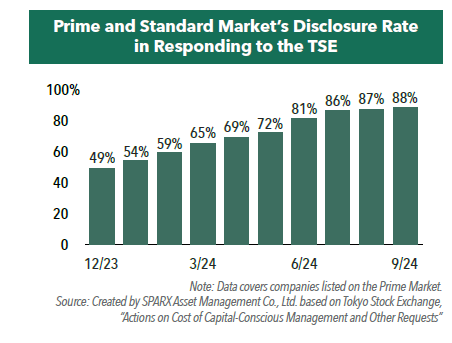

It has been over a year since the Tokyo Stock Exchange (TSE) initiated its corporate governance reforms, requesting listed companies to take measures aimed at “realizing management that is conscious of capital costs and stock prices.” As of the end of September 2024, 80% of companies in the Prime Market have disclosed initiatives in response to the TSE’s request, demonstrating their commitment to enhancing corporate value, while 8% of companies have disclosures under consideration.

While it’s encouraging to see companies beginning to take actions, true transformation will require time and sustained efforts. We are now entering a phase where these initiatives can be refined through engagement with investors.

In the small-cap market, direct communication with top management is more accessible, making it possible to selectively invest in companies that are committed to reform and poised to deliver excess returns.

Given the focus on book value improvements and capital efficiency, would you please discuss what you have seen with regard to shareholder friendly actions?

In recent years, large-cap companies have led the way in implementing shareholder-friendly actions, particularly through share buybacks. This proactive approach has set a precedent, with large-cap firms demonstrating a strong commitment to enhancing capital efficiency and returning value to shareholders.

However, we’re now observing a shift among small- to mid-cap companies, with a noticeable increase in share buyback announcements. While these companies have historically lagged behind their larger counterparts, they are now following suit, gradually adopting similar capital return strategies. This emerging trend reflects a growing focus on shareholder value, suggesting that more small- and mid-cap firms are recognizing the importance of capital efficiency and aiming to align with best practices in shareholder returns.

The momentum toward greater capital efficiency in the small- to mid-cap segment should not only enhance shareholder value but also signal a broader market shift toward sustainable growth and improved corporate governance.

What tailwinds do you see for Japanese small-cap stocks entering 2025 and moving forward?

We see the following tailwinds:

• Economic recovery and progress in corporate governance reforms: The ongoing recovery in the Japanese economy and advancements in corporate governance reform are setting the stage for growth in small-cap stocks.

• Beneficiaries of domestic demand: With a high exposure to domestic demand, small-cap stocks are well-positioned to benefit directly from Japan’s economic revival.

• Rising wages driving economic momentum: Japan’s economic recovery, fueled by wage increases, continues to gain traction. Notably, a 7% wage increase target has been set for 2025, underscoring a commitment to sustained growth.

• Corporate governance reforms reaching small-caps: Governance reforms initiated by the TSE are now extending to small-cap stocks. With an increasing number of companies disclosing their policies, the next phase involves concrete actions. This shift toward transparency and accountability may serve as a powerful catalyst for re-evaluation and renewed investor interest.

Please provide your overall 2025 outlook.

Although geopolitical tensions, particularly U.S.-China friction, remain high, Japan is expected to experience steady economic growth driven by a gradual shift to inflation, supported by ongoing wage increases. In addition, many companies that have struggled to pass on rising commodity and currency costs have seen delayed earnings normalization. As these companies recover, the likelihood of significant profit growth is high, presenting substantial upside potential for investors.

For the Hennessy Japan Small Cap Fund, we will continue to seek promising domestic demand-focused stocks, especially those capable of absorbing wage increases and maintaining growth, as they are well-positioned to benefit from Japan’s economic resilience.

- In this article:

- Japan

- Japan Small Cap Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Japan Small Cap FundFinding Compelling Japanese Small-Caps

Takenari Okumura, CMAPortfolio Manager

Takenari Okumura, CMAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the Commentary

Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the CommentaryThe Portfolio Managers discuss their bottom-up approach to identifying undervalued small-cap companies and where they are currently finding opportunity.

-

Portfolio Perspective

Portfolio Perspective

Japan FundBullish on Globally Oriented Japanese Companies

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio ManagerRead the Commentary

Angus Lee, CFAPortfolio ManagerRead the CommentaryIn the following commentary, the Hennessy Japan Fund Portfolio Managers share their thoughts on the current increased market volatility, portfolio updates, and their optimism on globally oriented Japanese companies.

-

Market Outlook

Market OutlookInvestment Outlook for Japanese Equities

Read the CommentaryDespite ongoing uncertainty, our Japan portfolio managers maintain a disciplined, long-term perspective, investing in quality companies at attractive valuations.