Seven & i Holdings Co., Ltd. - Poised to Become A Global Retail Champion

Seven & i operates a diverse range of businesses, including the convenience store chain, 7-Eleven. Seven & i aims to become a world-class food-focused retail group, utilizing technologies and providing new experiences. Recent shareholder activism and acquisition offers demonstrate the company’s attractiveness to investors.

-

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager -

Angus Lee, CFAPortfolio Manager

Angus Lee, CFAPortfolio Manager

A Successful Convenience Store Franchise

Seven & i Holdings Co., Ltd., (“Seven & i”) not only operates 7-Eleven, but also runs convenience stores, supermarkets, department stores, specialty stores, e-commerce platforms, financial services, and IT services in a total of 20 countries and regions around the world. Seven & i Holdings was formed in 2005 when Ito-Yokado, Seven-Eleven Japan, and Denny’s Japan merged.

As of fiscal year 2023, Seven & i stores welcome over 60 million customers per day worldwide in about 85,000 stores. The company employs about 160,000 part- and full-time workers as of February 2024.

A convenience store is in the business of selling everyday items in convenient locations. As a proven retail format, the allure of the convenience store business is that it boasts high capital efficiency, robust cash flow, and largely resilient sales performance in times of economic fluctuations.

Seven & i - Pioneer in the Industry

The convenience store format started in the U.S. and has subsequently evolved in Japan. Ito-Yokado, a former Japanese retail group (known as Seven & i Holdings today), first brought the concept to Japan in the 1970s after signing a franchise agreement with Southland Corp., the original brand owner in the U.S. Due to the ingenuity of the president of Seven-Eleven Japan, Toshifumi Suzuki, the company improved on the business model and scaled up to become the most powerful retailer in the country.

Some innovations and operational efficiencies introduced by the company focus on customers’ buying preferences to create a continous flow of products and include:

• The use of the point-of-sale system

• Frequent same-day shelf replenishment

• Ready-to-eat meal offerings

• Private-label merchandise

Seven-Eleven Japan became so successful that management ended up acquiring Southland Corp. (later renamed Seven-Eleven Inc.) when it declared bankruptcy in 1991. Today, the industry has three dominant players in Japan, namely Seven-Eleven, FamilyMart, and Lawson.

Overseas Growth Potential

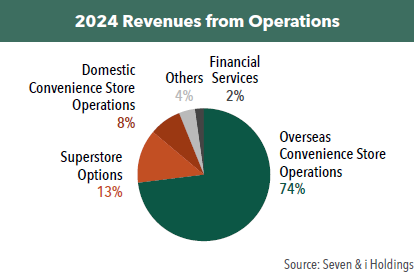

Currently, about half of the company’s profit comes from the U.S. Seven & i has long been expanding its U.S. presence since 2006, mainly through mergers and acquisitions (M&As). When it acquired rival convenience store and gas station chain Speedway in 2021, its U.S. store count became by far the largest in a still fragmented U.S. convenience store (CVS) industry.

The next growth phase for Seven & i may be Southeast Asia where personal incomes are quickly rising. Currently, 7-Eleven stores in Asia outnumber domestic peers by 2:1. However, the region’s contribution to total earnings is almost nonexistent because its Asian business is built around licensing contracts rather than a master franchise models. Under a typical licensing agreement, the headquarters grants the right to use the store brand, but the details of store layouts and operations are left to local operators’ discretion. This limited involvement results in only a small amount of licensing fees.

In the contrary arrangement, the standard franchise agreements used in Japan require the franchisees to pay the headquarters anywhere between 40-60% of store-level gross profits as royalty in return for various operational assistances. Such an arrangement is equivalent to 15-20% of store sales, a very profitable model. After a few decades of being in business, publicly listed area franchisees such as CP AlI PCL of Thailand and President Chain Store of Taiwan boast market cap of $14 billion and $8 billion, respectively, today. However, Seven & i does not own an interest in either one of these companies. Thus, it has been a loss of opportunity for the Seven & i shareholders.

Long-Term Prospects / Room for Improvement

We believe Seven & i has an opportunity to become a global retail champion given that 7-Eleven is one of the best-known retail brands in the world. With over 85,000 stores, it has more locations than McDonald’s (40,000+ stores) and Starbucks (35,000+ stores), yet 7-Eleven stores are only in 19 countries.1 Its main competitor, Canadian-based Alimentation Couche Tard is arguably the second largest CVS operator, and its operational metrics and track record is superior to Seven & i.

However, it is never too late to improve, and the U.S. alone should provide a significant growth runway. According to Grand View Research, revenue of the U.S. CVS industry is approximately $884 billion as of 2020 and remains fragmented. After the Speedway acquisition, Seven & i became the largest operator with about 9% share (approximately 13,000 stores out of 150,000 stores nationwide).2 Assuming the company can increase its unit share to 20% organically (as well as inorganically, with many roll-up deals possible) then its U.S. system-wide revenue could reach as much as $177 billion ($884 billion x 20%). Assuming a 2.5% net margin (FY2024 net profit margin (NPM) was 2.6%. Walmart has roughly 2.4% NPM), net profit will amount to more than $4.3 billion ($179.1 billion x 2.5% NPM) from the U.S. alone.

U.S. Sales Improvements Through Renovations and Operational Efficiencies

In recent years, Seven & i has had weak existing store performance. To address these challenges, management has been making changes, applying Japanese strategies to the U.S. to widen growth opportunities.

These changes include the following:

1. Renovating Existing Stores. Convenience stores in the U.S. are often attached to gas stations, and many customers shop there while filling up their tanks. These stores often lack cleanliness and even can make customers feel unsafe at times. There is a lack of incentive for customers to willingly shop at these convenience stores. Recognizing these issues, the company is aggressively renovating its existing stores, involving face-lifts to store signage, new bathrooms, and redrawing lane markings in the parking spaces.

2. Expanding its product lineup focusing on fresh food. Seven & i has been partnering with Warabeya Nichiyo Holdings, a supplier for Seven- Eleven Japan, rolling out commissaries to make a wide range of food offerings, such as sandwiches, burritos, hotdogs, rice balls, and ramen.

3. Applying its Japanese operational expertise. The company is also transferring its operational know-how such as “Tanpin Kanri” (Item-by-Item Management) from Japan. This system traces the movement of each merchandise item and collects massive demographic data on its customers’ buying behaviors to improve the accuracy of the next order placement for re-stocking. This also helps each store localize its assortment to the needs of customers.

Due to these initiatives, the same-store sales trend for the current fiscal year has been bottoming out with smaller year-over-year declines since July 2024, despite the downward pressure from the ongoing decline in cigarette sales demand.

Shareholder Activism Prompts Change

In recent years, pressure from activist investors including U.S.-based activist hedge fund company, ValueAct Capital, has driven changes in the company’s governance structure. ValueAct launched a shareholder campaign against Seven & i, escalating it to a proxy fight in 2023, demanding changes in leadership and governance, the company focus on core businesses, and increase return on capital. In the process, ValueAct claimed that Seven & i received an acquisition proposal from an “overseas retail company” in 2020, which was not made public. If true, it means shareholders were denied the opportunity to weigh the option of potentially selling their shares at a premium.

In conclusion, in May 2023, ValueAct’s proposals failed to win shareholder vote. However, it was not a complete defeat, in our view. The key incumbent directors’ (i.e., CEO Ryuichi Isaka, Executive Vice President Katsuhiro Goto, etc) approval ratings fell sharply to 65%-76% from above 90% in 2022. Considering this, we believe ValueAct brought to light shareholders’ concerns over current management, and its execution capabilities will be scrutinized.

Acquisition Offers May Unlock Company’s Potential

In 2024, Seven & i received a merger proposal from Canada’s Alimentation Couche-Tard, the global operator of the Circle K convenience store chain. In addition, three private equity firms bid for non-core assets of the company as Seven & i is looking to sell off non-core businesses. However, it was announced in early 2025 that Seven & i had abandoned its buyout effort after failing to secure financing.

As of January 2025, the Special Committee is objectively considering all options to realize the company’s potential value. The role played by ValueAct and the others in driving this transformative change in the company’s governance cannot be overstated.

While it is unclear what the outcome will be, Couche-Tard’s and other party’s indications of interest in Seven & i appears to demonstrate the company’s attractiveness to potential acquirers. Even if acquisition negotiations fail, the possibility of new buyers emerging remains high, which should mitigate the downside risk of its stock price. Meanwhile, the potential upside on this investment should the company be run successfully remains compelling.

The Opportunity: The Potential to Become a Global Retail Champion

The convenience store business is inherently an attractive retail business that generates high returns on capital and robust cash flow underpinned by stable demand given that it sells essential goods. Seven & i’s long record of accomplishment as a pioneer in this field also gives us a sense of “safe and sound business.”

With its immense potential for overseas expansion including the U.S. along with its global brand recognition as the parent company of 7-Eleven, Seven & i looks poised to become a global retail giant.

- In this article:

- Japan

- Japan Fund

1: 7-eleven.com. 2: Company website/presentation

You might also like

-

Portfolio Perspective

Portfolio Perspective

Japan FundJapan’s Evolving Investment Landscape in 2025

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio ManagerRead the Commentary

Angus Lee, CFAPortfolio ManagerRead the CommentaryIn the following commentary, the Hennessy Japan Fund Portfolio Managers summarized what most surprised them in 2024 about the Japanese market along with positive trends driving Japanese companies.

-

Portfolio Perspective

Portfolio Perspective

Japan Small Cap FundJapanese Small-Caps: Attractive Valuations with Potential for Sustained Growth

Takenari Okumura, CMAPortfolio Manager

Takenari Okumura, CMAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the Commentary

Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the CommentaryThe Portfolio Managers summarize the 2024 Japanese market and discuss the compelling opportunities they are finding in undervalued Japanese small-cap companies.

-

Investment Idea

Investment IdeaCompelling Valuations in Japan

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio Manager

Tadahiro Fujimura, CFA, CMAPortfolio Manager Takenari Okumura, CMAPortfolio ManagerRead the Investment Idea

Takenari Okumura, CMAPortfolio ManagerRead the Investment IdeaJapanese equities are currently trading at compelling valuation levels compared to other developed equity markets around the world and relative to their own historical averages. We believe the Japanese market deserves a closer look.