Earnings Growth, Value and Momentum - A Strategy for Success

In the following commentary, the Portfolio Managers of the Hennessy Cornerstone Growth Fund discuss the Fund’s formula-based investment strategy and how it drives the Fund’s sector and industry positioning.

-

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager -

L. Joshua Wein, CAIAPortfolio Manager

L. Joshua Wein, CAIAPortfolio Manager

What is the Hennessy Cornerstone Growth Fund’s investment strategy?

The Fund utilizes a formula-based approach to build a portfolio of attractively valued, growth stocks whose stock prices are exhibiting strong relative strength. In essence, the strategy seeks to combine elements of both value and momentum investing. From the universe of stocks in the S&P Capital IQ Database, the Fund selects the 50 stocks with the highest one-year price appreciation that also meet the following criteria:

» Market capitalization exceeding $175 million

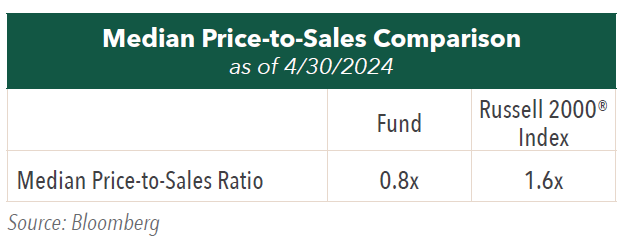

» Price-to-sales ratio below 1.5

» Annual earnings higher than the previous year

» Positive stock price appreciation over the past three- and six-month periods

Why does the Fund use these screening criteria?

The Fund uses a sales-based value criterion because sales are more difficult to manipulate than earnings. The price-to-sales ratio works well under many conditions, including when a company’s profitability may be temporarily depressed or when earnings may be artificially inflated.

Higher year-over-year earnings helps identify growth stocks, i.e. companies that are operating successfully in growth markets, gaining market share, or increasing their profitability.

Positive price appreciation over three- and six-month periods generally reflects market recognition of improving underlying fundamentals in the near term.

Why does the formula select stocks with the highest one-year price appreciation?

From among the companies that meet the screening criteria, the Fund selects the 50 with the highest one-year price appreciation. We believe this ranking by relative share price strength can be a good predictor of future price appreciation, or outperformance.

How does the Fund seek to provide a return to investors?

We believe the Fund’s investments present the potential for capital appreciation as a result of earnings growth and potentially higher valuations.

How often does the Fund rebalance its portfolio?

The universe of stocks is re-screened and the portfolio is rebalanced annually, generally in the winter. Holdings are weighted equally by dollar amount with 2% of the Fund’s assets invested in each.

How does the Fund’s portfolio differ from its benchmark?

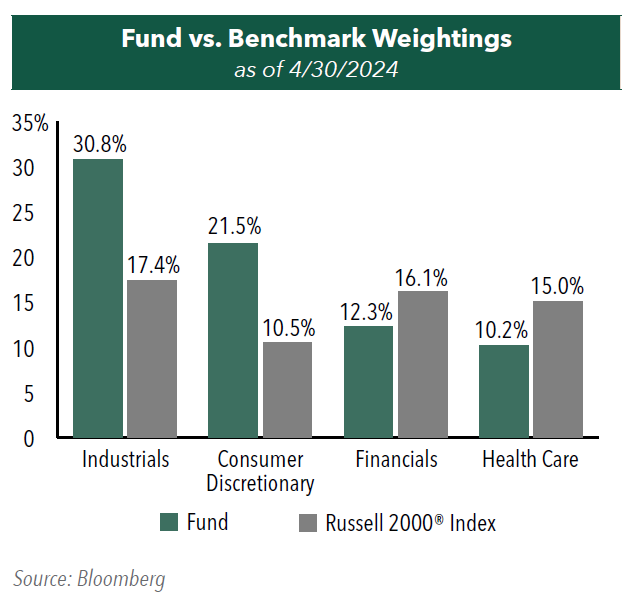

Compared to its benchmark, the Russell 2000® Index, the Fund has substantial overweight positions in the Industrials & Consumer Discretionary sectors. While the next two largest weightings are Financials and Health Care, we note that they are underweight the benchmark by 4% and 5%, respectively. Lastly, the Fund is diversified across all sectors except Utilities.

The Fund’s largest sector weighting is Industrials, at 16 holdings, which we believe could experience a period of increased revenues and profitability as inflation abates, domestic manufacturing and construction activity increases, and the global economy improves. Consumer Discretionary exposure, comprised of 12 individual stocks, could continue to benefit from an improving economic outlook as well as increased consumer spending and demand for goods and services.

The Fund also has significant exposure to Financials and Healthcare. Financial exposure is concentrated in insurance and consumer finance, and Health Care is composed of both healthcare facilities and services as well as pharmaceuticals.

- In this article:

- Domestic Equity

- Cornerstone Growth Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Cornerstone Large Growth FundHigh Profitability and Attractive Valuations – A Compelling Combination

Neil J. HennessyChief Market Strategist and Portfolio Manager

Neil J. HennessyChief Market Strategist and Portfolio Manager Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryIn the following commentary, the Portfolio Managers of the Hennessy Cornerstone Large Growth Fund discuss the Fund’s formula-based investment process and how it drives the Fund’s sector and industry positioning.

-

Portfolio Perspective

Portfolio Perspective

Cornerstone Value FundDriven by Revenues, Cash Flow, and High Dividend Yields

Neil J. HennessyChief Market Strategist and Portfolio Manager

Neil J. HennessyChief Market Strategist and Portfolio Manager Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryIn the following commentary, the Portfolio Managers of the Hennessy Cornerstone Value Fund discuss the Fund’s formula-based investment strategy and how it drives the Fund’s sector and industry positioning.

-

Portfolio Perspective

Portfolio Perspective

Focus FundLong-term Investing in a Concentrated Collection of Businesses

David Rainey, CFACo-Portfolio Manager

David Rainey, CFACo-Portfolio Manager Ira Rothberg, CFACo-Portfolio Manager

Ira Rothberg, CFACo-Portfolio Manager Brian Macauley, CFACo-Portfolio ManagerRead the Commentary

Brian Macauley, CFACo-Portfolio ManagerRead the CommentaryIn the following commentary, the Portfolio Managers of the Hennessy Focus Fund summarize the 2024 market and provide their insights on their 2025 outlook, including the impact on holdings from presidential administration’s policy changes and the growth of AI.