Drivers of Natural Gas Utilities in 2025

Following natural gas utilities’ strong 2024 performance highlighted by robust earnings growth, many factors could drive the stocks in the new year including U.S. energy policies, artificial intelligence (AI), and attractive dividend levels.

-

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager

Ryan C. Kelley, CFAChief Investment Officer and Portfolio Manager -

L. Joshua Wein, CAIAPortfolio Manager

L. Joshua Wein, CAIAPortfolio Manager

Key Takeaways

» Natural gas utilities performed in line with the overall market and experienced robust EPS growth.

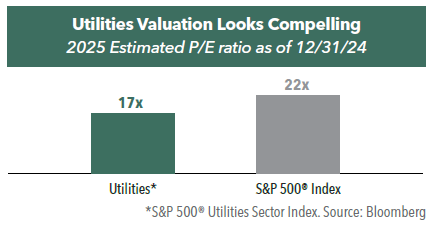

» Utilities trade at a 20% discount to the S&P 500 on a forward P/E basis, potentially offering room for above average appreciation.

» AI is set to increase energy demand, with natural gas positioned as the reliable fuel choice to support rising demand.

» Dividend-paying Utilities may be more attractive in a declining rate environment.

What surprised you the most in 2024 as it related to natural gas utilities?

There were several surprising developments in the natural gas market over the past year:

1. Strong 2024 performance in line with the overall market returns. The AGA Stock Index and the S&P 500® Index both ended the year up 25% on a total return basis. Returns were generally steady throughout 2024 although there was a bump in performance from July to October as investors anticipated the Federal Reserve’s interest rate cut.

2. Contraction in price-to-earnings (P/E) multiple. At the end of 2023, the P/E ratio for the S&P 500® Utilities Index was 18x and by the end of 2024, it declined to 17x.

3. Strong earnings per share (EPS) growth. Utilities’ long-term average EPS has been approximately 5% to 7%. Yet, after four years of flat growth, 2024 estimated EPS is expected to grow approximately 23%. We believe this strong growth is a testament to the long-term steady growth in capital expenditures. Further, in 2025 and 2026, EPS growth is estimated to be 6% to 9% per year—above its long-term average.

How might the new administration’s energy policies impact natural gas demand?

The incoming administration has proposed a few ideas as it relates to U.S. energy policies. For one, there could be a repeal of tax credits for electric vehicles as well as a loosening of clean power standards that relate to electricity generation. In addition, the administration may also lift the temporary pause on new export permits for liquefied natural gas (LNG). While 5 U.S. LNG export projects have been approved by the Federal Energy Regulatory Commission (FERC), they are still awaiting the Department of Energy approval.

Regardless of the new administration’s final energy policies, it seems clear that natural gas will remain an important part of the energy needs in the U.S. going forward.

How does the P/E ratio of Utilities compare to that of the S&P 500, and what does that say about their future appreciation potential?

As of the end of 2024, the P/E ratio for the S&P 500 based on 2025 earnings was 22x compared to Utilities’ 17x. The overall market’s current P/E ratio is near the midpoint of its 10-year range, as the S&P 500 has traded between 17x and 26x. In comparison, Utilities have traded in a tighter P/E band—16x to 22x—over the past decade.

Historically, Utility stocks have, at times, traded at a premium to the S&P 500. Therefore, given their current 20% discount to the market along with higher EPS growth potential, we believe there is more room to run for Utilities.

How might artificial intelligence (AI) developments affect natural gas demand?

AI usage is anticipated to significantly increase power demand. As an example, each ChatGPT search requires approximately 10x more energy than a Google search. As a result, by 2030, data centers are expected to comprise 8% of total power usage, triple 2022’s usage. To handle the immense computational demands of AI workloads, companies such as Microsoft, Amazon, and Google are leading the development of AI mega-campuses of data centers that could require as much as five gigawatts of power use.

Currently approximately two-thirds of power generation relies on natural gas and coal. Given its efficiency, affordability, reliability, and abundance, we anticipate natural gas will be the fuel of choice for this increased demand. Energy demand is needed 24 hours a day, requiring reliable power, so while wind and solar usage is expected to grow, natural gas can complement renewable sources.

There may be economic implications, as the rise in natural gas demand could lead to price volatility. However, as “toll takers,” Utility companies typically benefit from higher volumes of natural gas usage, i.e., the more the meter spins, the more money they make. Further, the price of the commodity is a pass-through to the customer, so volume flowing through pipelines is more important to the growth of these companies than the price of the commodity.

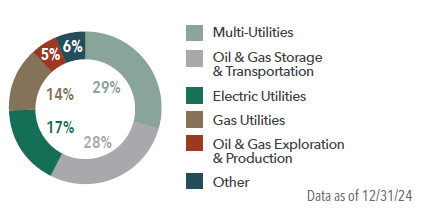

What is the current composition of the Hennessy Gas Utility Fund?

There are five primary sub-industries represented in the Fund. As of the end of the fourth quarter of 2024, the largest was multi-utilities, which comprised 29% of the Fund’s assets, followed by oil and gas storage and transportation companies, which made up 28%. Electric utilities and pure play natural gas utilities comprised 17% and 14%, respectively, as of December 31, 2024, and oil and gas exploration and production was 5%.

Would you please discuss the current level of dividends for the Fund’s holdings?

Of the 48 companies in the Fund, only one does not currently pay a dividend. As of year-end 2024, the average dividend yield of the companies in the Fund was 3.6%.1 The Fund has seen a steady growth in dividends, with the one-year growth in dividends at 5%; the three-year annualized growth in dividends was 5.4%. In addition, the payout ratio was approximately two-thirds of earnings, as Utilities typically pay out the majority of their earnings.

We believe if rates continue to decline in 2025, dividend-paying companies may look more attractive to investors.

Please summarize the case for natural gas utilities in 2025.

Utilities experienced strong returns in 2024. In fact, Utilities was one of the best performing sectors in the S&P 500. However, we believe there remains room for positive momentum due to the following:

1. P/E normalization and projected earnings growth.

2. Attractive and long-standing dividend levels, especially as rates decline.

3. Record levels of production of natural gas.

4. Record demand for natural gas, especially as it relates to AI usage.

5. Less regulation could encourage long-term capital expenditures, boosting future earnings.

In summary, we believe that natural gas utilities remain an attractive investment choice and that natural gas remains a necessary and desirable complement to clean energy.

- In this article:

- Energy

- Gas Utility Fund

You might also like

-

Investment Idea

Investment IdeaDefining the Energy "Value Chain"

Ben Cook, CFAPortfolio ManagerRead the Investment Idea

Ben Cook, CFAPortfolio ManagerRead the Investment IdeaEnergy is a large and complex sector. The sector’s broad sub-industries can be divided into a “value chain,” each segment of which has different characteristics and offers different investment opportunities.

-

Portfolio Perspective

Portfolio Perspective

Midstream FundWhat’s Driving Midstream Company Performance?

Ben Cook, CFAPortfolio Manager

Ben Cook, CFAPortfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryThe Portfolio Managers Ben Cook, CFA and Josh Wein share their insights on midstream companies’ strong performance over the past year, their shareholder-friendly capital allocation approach and current valuations.

-

Portfolio Perspective

Portfolio Perspective

Energy Transition FundEnergy Transition Outlook 2025 – Key Investment Opportunities

Ben Cook, CFAPortfolio Manager

Ben Cook, CFAPortfolio Manager L. Joshua Wein, CAIAPortfolio ManagerRead the Commentary

L. Joshua Wein, CAIAPortfolio ManagerRead the CommentaryThe U.S. continues to be an engine of growth when it comes to energy production. The following commentary summarizes the 2024 market and what to expect in the new year.