Compelling Valuations in Japan

Japanese equities are currently trading at compelling valuation levels compared to other developed equity markets around the world and relative to their own historical averages. We believe the Japanese market deserves a closer look.

-

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager -

Tadahiro Fujimura, CFA, CMAPortfolio Manager

Tadahiro Fujimura, CFA, CMAPortfolio Manager -

Takenari Okumura, CMAPortfolio Manager

Takenari Okumura, CMAPortfolio Manager

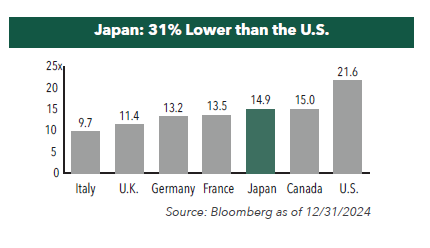

1. Attractive Price-to-Earnings Multiple

The price-to-earnings multiple, or P/E ratio, is the most common measure used to value equities. Japanese large-cap equities, as represented by the Tokyo Price Index (TOPIX), are currently trading on a P/E multiple of 14.9x 2024 forward earnings, 31% lower than the U.S.

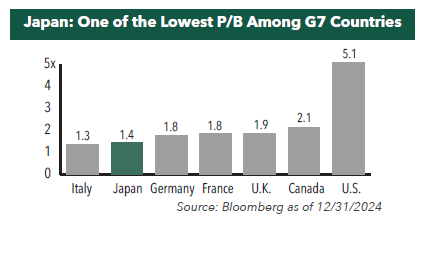

2. Low Price-to-Book

On a price-to-book basis (P/B), Japanese equities are also offering investors great value compared with other global developed equity markets. TOPIX is trading at just 1.4x book value, about a third lower than the average among the top developed equity markets and more than two-thirds lower than the U.S.

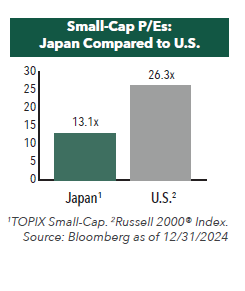

3. Japan Small-Caps at a Discount

Small-cap Japanese companies are also trading at a discount to international peers. Small-cap stocks in Japan are trading on just 13.1x 2025 forward earnings, and as a point of reference, a 50% discount to U.S. small caps trading at 26.3x.

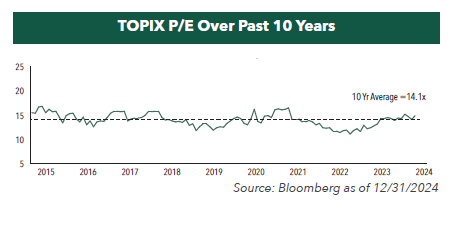

4. Japan’s Attractive P/E Relative to History

Japan’s current 2025 forward P/E multiple is about the same as its 10-year average of 14.0x.

Summary

We believe Japan’s growth story is just starting to unfold. Following the advent of Abenomics, many Japanese companies are experiencing higher profitability due to corporate restructuring, better governance, and a more competitive currency. With Japanese equities currently offering attractive valuations compared to G7 developed country equity markets and relative to history, we believe Japan deserves a closer look as a component of an investor’s portfolio.

- In this article:

- Japan

- Japan Fund

- Japan Small Cap Fund

You might also like

-

Company Spotlight

Company Spotlight

Japan FundSeven & i Holdings Co., Ltd. - Poised to Become A Global Retail Champion

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio ManagerRead the Spotlight

Angus Lee, CFAPortfolio ManagerRead the SpotlightSeven & i operates a diverse range of businesses, including the convenience store chain, 7-Eleven. Seven & i aims to become a world-class food-focused retail group, utilizing technologies and providing new experiences. Recent shareholder activism and acquisition offers demonstrate the company’s attractiveness to investors.

-

Portfolio Perspective

Portfolio Perspective

Japan FundJapan’s Evolving Investment Landscape in 2025

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio ManagerRead the Commentary

Angus Lee, CFAPortfolio ManagerRead the CommentaryIn the following commentary, the Hennessy Japan Fund Portfolio Managers summarized what most surprised them in 2024 about the Japanese market along with positive trends driving Japanese companies.

-

Portfolio Perspective

Portfolio Perspective

Japan Small Cap FundJapanese Small-Caps: Attractive Valuations with Potential for Sustained Growth

Takenari Okumura, CMAPortfolio Manager

Takenari Okumura, CMAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the Commentary

Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the CommentaryThe Portfolio Managers summarize the 2024 Japanese market and discuss the compelling opportunities they are finding in undervalued Japanese small-cap companies.