Japan’s Evolving Investment Landscape in 2025

In the following commentary, the Hennessy Japan Fund Portfolio Managers summarized what most surprised them in 2024 about the Japanese market along with positive trends driving Japanese companies.

-

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager -

Angus Lee, CFAPortfolio Manager

Angus Lee, CFAPortfolio Manager

Key Takeaways

» The magnitude of the market sell-off in August resulted in several portfolio buying opportunities. In a weaker yen environment, Japanese exporters generally benefit although they have become more currency resistant.

» We expect Japanese companies to implement a pay increase during the annual spring wage negotiation season, which could result in positive real wage growth.

» Several positive trends cause us to be bullish on Japanese companies going forward including the progress of corporate governance reforms, inflation, and the normalization of interest rates.

» We believe Japanese companies remain attractively valued relative to U.S. companies.

» Due to Japan’s unique culture, active management may be the best way to access Japanese companies. At SPARX, our portfolio managers have a deep understanding of the inner workings of corporate Japan.

What surprised you most about the Japanese market in 2024?

The magnitude of the market decline on August 5th was the biggest surprise in 2024. August’s unprecedented market sell-off was the worst day for Japanese markets since “Black Monday” in 1987. The trigger was the sudden unwinding of speculative short positions in the Japanese yen (JPY) known as carry trades, which had been a factor behind the currency’s depreciation. Speculative traders use carry trades, and the yen is used as a funding currency to invest in higheryielding risk assets. The unwinding caused a surge in the yen and a massive downturn in Japanese stocks.

Importantly, we believe the sharp decline in stock prices was not due to a deterioration of business fundamentals. Thus, this often creates mispricing of securities where their prices deviate significantly downward from their intrinsic value. As active, bottom-up investors, we seek to take advantage of this volatility by purchasing shares at attractive prices.

During the August turmoil, we played to our strength by purchasing more shares of companies that represent our high-conviction ideas.

Would you please discuss your thoughts on the ability for Japanese companies to be profitable in this environment?

The yen will likely remain the funding currency for carry trades because interest rates in Japan remain low. The Japanese yen continues to be the only major currency with negative real interest rates, creating interest rate differentials with other currencies. Even though we have been seeing rate hikes by the Bank of Japan, real rates remain negative.

However, a weaker yen improves the earnings of many Japanese exporters. In addition, due to the restructuring of businesses and improved corporate governance since Abenomics began in 2012, we believe corporate Japan is more currency resistant than it has historically been.

For the Hennessy Japan Fund, we seek global exporters with foreign currency exposure. As such, the Fund should benefit from the improved yendenominated revenue and earnings that potentially translate to a higher share price.

What are the expected wage hikes for 2025?

Every spring, there is a customary wage negotiation when labor unions across Japan meet with the management of companies to negotiate base salary increases. In 2023, nominal wages increased an average of 3.6%, and in 2024, wages were hiked another 5.1% on average. These were significant backto- back increases, as wage growth had been anemic for decades.

When inflation is factored in, real wage growth continues to be negative. However, we believe real wage growth will turn positive in the foreseeable future. The government has been encouraging businesses in Japan to raise wages, and as a result, we see many companies supporting this effort. This is a positive trend as it results in increased consumption, business growth and potentially higher stock prices.

Looking ahead, various surveys project continued pay hikes this year. At this juncture, it seems that most corporate managements may be looking at a similar level of wage hikes for 2025.

Would you please provide your outlook on Japan?

We believe the Japanese equity market has always included high-quality international companies. For over 20 years, the Hennessy Japan Fund has invested in many of these globally oriented leaders. Now a confluence of macro factors has made us even more bullish. These trends include the following:

• The progress of corporate governance reforms. Many Japanese companies have become more shareholder friendly. As one example, the Tokyo Stock Exchange introduced a “name and shame” initiative to drive better governance and higher valuations from companies that had a price to book ratio below 1x.

• An accommodative rate policy. We believe the Bank of Japan (BoJ) will continue to pursue a gradual normalization of interest rates. There is room for rates to rise, but the BoJ may take its time due to past central bank experiences of prematurely increasing rates in the past. We believe the governor will err on the side of higher inflation to make sure the Japanese economy is on solid footing and that inflation is sustainable.

• A consistency in domestic inflation. While there was no inflation in Japan for many years, the current inflation rate of 2%+ should drive additional growth, resulting in potentially a higher return on equity ratio and higher stock prices.

• Increased participation by retail investors in Japan. There is approximately $15 trillion worth of liquid household financial assets, excluding real estate, and about $8 trillion is in bank savings earning little to no interest. The total market capitalization of the Japanese stock market is $6.4 trillion as of the end of 2024. Therefore, a potential rotation from savings to investments could be significant.

How do valuations in Japan compare to those in the U.S.?

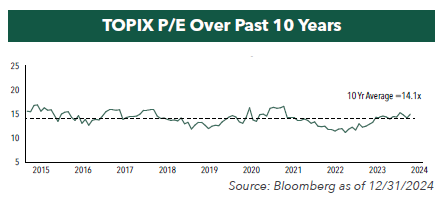

We do not believe Japanese stocks reflect the positive trends mentioned above as the price-to-earnings ratio of the Tokyo Price Index (TOPIX) continues to be the same as the 10-year average.

In addition, Japanese companies also appear to be relatively inexpensive compared to U.S. stocks. As of the end of 2024, the price-to-earnings (P/E) and price-to-book (P/B) for the TOPIX was 14.9x and 1.4x, respectively. The S&P 500 Index had a P/E and P/B of 21.6x and 5.1x as of the same period.

How could active management benefit an investor in Japanese companies?

Japan’s language and corporate culture are unique, and therefore, we believe the best way to access the market is by active management with research teams who understand the nuances of Japan and may have decades-long relationships with the management of domestic companies. Portfolio managers who understand the inner workings of Japanese companies and the market as a whole can interpret and translate research into potentially winning investment ideas.

In addition, the major Japanese indices are dominated by large, mature, low-growth companies. However, there are many highquality, long-term growth opportunities not wellrepresented in the indices.

For these reasons, we encourage investors to consider an actively managed fund such as the Hennessy Japan Fund. At SPARX Asset Management, our Asia-based experienced professional money managers practice a research-intensive investment process and have a deep understanding of the inner workings of corporate Japan.

- In this article:

- Japan

- Japan Fund

You might also like

-

Company Spotlight

Company Spotlight

Japan FundSeven & i Holdings Co., Ltd. - Poised to Become A Global Retail Champion

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio ManagerRead the Spotlight

Angus Lee, CFAPortfolio ManagerRead the SpotlightSeven & i operates a diverse range of businesses, including the convenience store chain, 7-Eleven. Seven & i aims to become a world-class food-focused retail group, utilizing technologies and providing new experiences. Recent shareholder activism and acquisition offers demonstrate the company’s attractiveness to investors.

-

Portfolio Perspective

Portfolio Perspective

Japan Small Cap FundJapanese Small-Caps: Attractive Valuations with Potential for Sustained Growth

Takenari Okumura, CMAPortfolio Manager

Takenari Okumura, CMAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the Commentary

Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the CommentaryThe Portfolio Managers summarize the 2024 Japanese market and discuss the compelling opportunities they are finding in undervalued Japanese small-cap companies.

-

Investment Idea

Investment IdeaCompelling Valuations in Japan

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio Manager

Tadahiro Fujimura, CFA, CMAPortfolio Manager Takenari Okumura, CMAPortfolio ManagerRead the Investment Idea

Takenari Okumura, CMAPortfolio ManagerRead the Investment IdeaJapanese equities are currently trading at compelling valuation levels compared to other developed equity markets around the world and relative to their own historical averages. We believe the Japanese market deserves a closer look.