"Feet-on-the-Street" Insights on the Japanese Economy and Equity Market

Masa Takeda of Tokyo-based SPARX Asset Management Co., Ltd., subadvisor to the Hennessy Japan Fund, shares his “feet-on-the-street” perspective on the recent sales tax hike, the rise in dividends and share buybacks, Japanese equities’ low valuations, and how the Fund is positioned for 2020.

-

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager

What impact has Japan’s recent sales tax hike had?

Contrary to the negative reaction to prior tax hikes, Japan’s sales tax increase, which took place in October 2019 and raised the rate from 8% to 10%, has been largely uneventful. In preparation for this tax hike, the government took a preemptive approach, budgeting about $25 billion—about half of the projected increase in tax burden on households—to develop countermeasures to soften the impact. Specifically, Japan waived the tax hike on groceries and small ticket items and introduced a loyalty point program for consumers who use digital payments to save up to 5% on future purchases.

While there have been some signs of a pullback in consumption activity in certain areas, such as car sales and department store sales, the overall impact appears to be less severe compared to the last tax hike in 2014, when there was a significant decline in consumer spending.

What is driving shareholder-friendly initiatives?

Shareholder-friendly initiatives began in 2013, when Prime Minister Shinzo Abe and his government unrolled their ambitious economic revitalization plan. One major area of focus was corporate governance reforms, which led to the adoption of initiatives that encouraged constructive discussions between investors and companies for a more efficient use of capital.

As a result of these initiatives, management teams have become more focused on driving return on equity (ROE). While Japanese companies’ ROE continues to be lower than its Western peers, there is an increased awareness from corporate management to improve. In the last five years, ROE of Japanese companies has improved significantly.

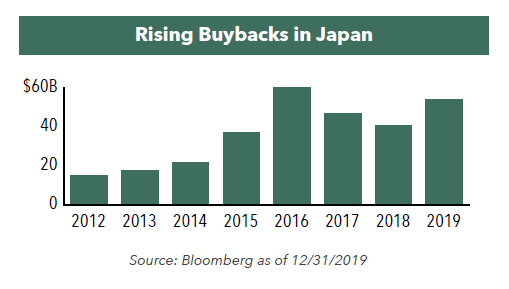

With approximately $5 trillion in cash on Japanese companies’ balance sheets, we believe the trend of share buybacks and increased dividends should continue into 2020 and beyond.

Would you comment on equity valuations?

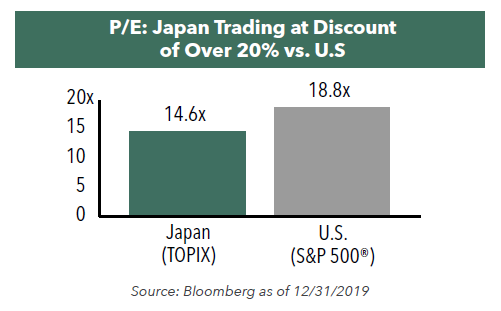

As of 12/31/19, the Tokyo Stock Price Index (TOPIX) is trading at 14.6x forward earnings, slightly lower than its 10-year average and over 20% lower than the S&P 500® Index, which is trading at 18.8x forward earnings.

In some respects, the Japanese market’s price to earnings (P/E) multiple does not reflect the ongoing structural improvements, such as the continuous push toward improved corporate governance, and the appropriate policy mix that the pro-business government and pro-inflation, pro-growth central bank have in place. There are a number of tailwinds, including an improving global economy, low interest rates, better corporate governance, a benign currency environment, and higher labor productivity which should help Japan return to earnings growth rates of high single digits to 10% in 2020.

Recently announced fiscal stimulus should improve market sentiment and support growth momentum. We believe the reform-minded, pro-business government and pro-inflation, pro-growth central bank have the right policy mix in place to help the Japanese economy and companies grow.

How has the U.S.-China trade war affected Chinese consumers’ demand for Japanese goods? How has it affected Hennessy Japan Fund portfolio companies?

To help gauge the impact of the trade war, we can look at Japan’s inbound tourist trends and the local consumer trends in China. While inbound Chinese tourism to Japan continued to be strong in 2019, spending was weaker primarily due to China’s economic slowdown and weaker currency. On the other hand, in China, demand for Japanese products remains robust. This strength has helped the Fund’s consumer stocks, such as Kao, Unicharm, and Rohto Pharmaceutical, regain ground from the recent lows in the second half of 2019. As an example, Rohto Pharmaceutical’s China segment in the most recent quarter grew between 6%-8% and domestic sales to inbound tourists also stabilized.

Tokyo will host the 2020 Olympic Games in July/August. What could be the economic impact?

The Olympic Games will showcase Japan’s many attractions, which we believe will draw in more tourists from around the world after the Games end. Over the past 10 years, the number of inbound tourists has more than quadrupled to 32 million people in 2019; tourists totaled only 7 million people a decade ago. The average tourist spends between $1,200 and $1,500, with the overall contribution to the economy totaling about $40 to $50 billion, or about 1% of the economy currently.

We believe there is significant room for increased tourism to boost the economy going forward. Should the Japanese economy boom, our Fund’s holdings should also benefit from an increase in domestic revenue.

What are the major tenets to your investment strategy for the Hennessy Japan Fund?

At SPARX Asset Management, our investment mantra is to invest in great businesses with exceptional management teams at attractive prices. We are patient investors focused on high-quality, globally oriented companies protected by high entry barriers. We prefer companies that generate a high level of cash flow and possess sustainable and predictable earnings growth over longer periods.

The Hennessy Japan Fund is a concentrated portfolio comprised of 25 holdings as of December 31, 2019. As a result of our long-term orientation, the Fund’s turnover ratio was only 12% in 2019. Although the portfolio is concentrated, it is also diversified. Within the portfolio, the top holdings span a broad range of industries, such as internet technology, medical devices, factory automation, media, bicycle parts, motor manufacturing, baby diapers, cosmetics, and retailing.

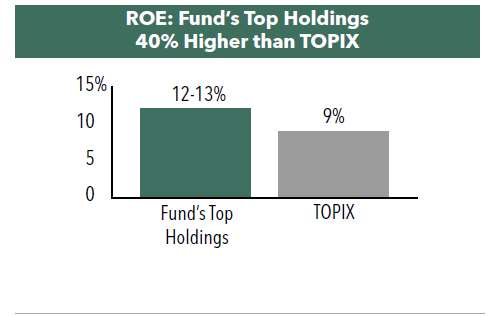

We believe the Fund is well-positioned with its portfolio of attractive companies expected to grow their earnings at a range between the high single digits to 10%+. The ROE range of our top holdings is approximately 12% to 13%, which is approximately 40% higher than the TOPIX’s ROE of 9% as of December 31, 2019.

- In this article:

- Japan

- Japan Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Japan FundJapan’s Evolving Investment Landscape in 2025

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio ManagerRead the Commentary

Angus Lee, CFAPortfolio ManagerRead the CommentaryIn the following commentary, the Hennessy Japan Fund Portfolio Managers summarized what most surprised them in 2024 about the Japanese market along with positive trends driving Japanese companies.

-

Portfolio Perspective

Portfolio Perspective

Japan Small Cap FundJapanese Small-Caps: Attractive Valuations with Potential for Sustained Growth

Takenari Okumura, CMAPortfolio Manager

Takenari Okumura, CMAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the Commentary

Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the CommentaryThe Portfolio Managers summarize the 2024 Japanese market and discuss the compelling opportunities they are finding in undervalued Japanese small-cap companies.

-

Investment Idea

Investment IdeaCompelling Valuations in Japan

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio Manager

Tadahiro Fujimura, CFA, CMAPortfolio Manager Takenari Okumura, CMAPortfolio ManagerRead the Investment Idea

Takenari Okumura, CMAPortfolio ManagerRead the Investment IdeaJapanese equities are currently trading at compelling valuation levels compared to other developed equity markets around the world and relative to their own historical averages. We believe the Japanese market deserves a closer look.