Is it Time for a Big Rebound in Japanese Small-Caps?

The Portfolio Managers discuss the challenges Japanese small-caps have faced amid the depreciation of the yen and the resulting valuation misalignment that could present opportunity for active investors.

-

Tadahiro Fujimura, CFA, CMAPortfolio Manager

Tadahiro Fujimura, CFA, CMAPortfolio Manager -

Takenari Okumura, CMAPortfolio Manager

Takenari Okumura, CMAPortfolio Manager

TOPIX has outperformed Japanese smaller companies on a YTD basis. What is driving the performance of the TOPIX relative to the Fund?

As of the end of June, TOPIX has risen 5% while the Russell/Nomura Small CapTM Index fell 1%. We believe TOPIX’s relatively strong performance is driven by several key factors:

1. A favorable currency environment that boosts exporters’ earnings growth.

2. The Tokyo Stock Exchange’s (TSE) continued efforts to drive market reforms.

3. Expectations for wage increases during the nationwide spring wage negotiation season.

4. Japan’s position as a geopolitically neutral destination for global equity investors.

5. The New Nippon Individual Savings Account (NISA) program, a tax-free investment savings account for individuals that began in January 2024.

Additionally, generative AI has captured significant market attention. Companies like Hitachi, Tokyo Electron, and Shin-Etsu Chemical, recognized for their involvement in generative AI technologies, have seen their stock prices soar.

On the other hand, Japanese smaller companies have faced some challenges amid continued yen depreciation and inflation. Today, moderate inflation has become more prevalent, initially driven by rising commodity prices and now further influenced by yen depreciation. Although the burden of rising procurement costs for raw materials has increased, Japanese smaller companies have struggled to pass on these rising costs. As a result, their earnings growth has been relatively lower than those of large-cap companies. However, as small and mid-sized companies continue to implement price increases to offset rising costs, we believe their performance will gradually recover, leading to a revaluation of small and mid-cap stocks.

Would you please discuss valuation metrics in Japanese small vs. large cap stocks?

Japanese small and mid-cap stocks are currently in an intriguing position. Despite showing significant growth potential, they remain undervalued compared to large-cap stocks. Over the past three years, small-cap stocks have been consistently undervalued, yet going forward, they are demonstrating higher profit growth expectations than large-caps. This dichotomy suggests a misalignment in market valuation that could present lucrative opportunities for savvy investors.

How are small domestic companies affected by higher inflation in Japan and the depreciation of the yen? What actions can they take in the short run to offset the negative impact?

Inflation has become more prevalent today, which has initially been driven by rising commodity prices and now further influenced by yen depreciation.

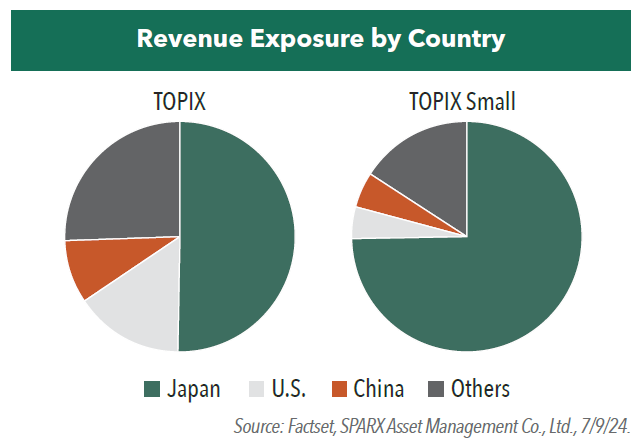

This trend has affected small companies to a greater significance compared to larger companies. Take revenue exposure as an example. Among TOPIX Small companies, approximately 80% of sales are domestic while 20% are overseas whereas sales of companies in TOPIX are approximately 50/50. With its high ratio of overseas sales, larger companies have a stronger ability to earn foreign currency, resulting in higher revenue in Japanese yen terms. The depreciation of the yen is expected to exacerbate the rising costs of imported raw materials and fuel, adversely affecting the operations of small and medium-sized enterprises in sectors with high import dependency, such as construction and retail.

In response to the current situation, Japanese smaller companies have started to pass on rising costs. In Japan, where a prolonged deflationary environment has still persisted, implementing price increases has been difficult. However, corporate management mindsets are gradually changing, and they are now actively considering price adjustments to secure sufficient margins.

What are the benefits of increased tourism to Japanese businesses?

Inbound tourism is a bright spot. Japan, having opened up to tourism only about 15 years ago, saw a peak in 2019 with each tourist spending approximately $1,200 to $1,500, contributing $40-45 billion to GDP. This sector, which suffered during the pandemic, is now rebounding strongly, aided by the depreciated yen which increases tourists’ purchasing power. In March 2024, the number of inbound tourists to Japan surpassed 3 million in a single month for the first time in history. This trend continued for three consecutive months, with over 3 million tourists each month as of May 2024. The numbers are on track to exceed the pre-COVID peak of 31.88 million annual visitors.

J. Front Retailing Co., Ltd., a major Japanese retail company best known for operating the department store chains Daimaru, is a direct beneficiary of inbound tourism. The company’s store network is primarily centered in Osaka, Kyoto, and Tokyo, making it well-positioned to cater to the needs of inbound tourists. As inbound tourists spread from Tokyo to regional areas, inbound consumption is also expanding to major regional cities. The firm is preparing for the redevelopment project in Nagoya, a Japan’s fourth most populous city and is a major economic and cultural hub, set to open in 2026. Despite having conservative business plans for the next three years, the strong inbound demand is driving performance at a pace that suggests the mid-term management plan will be achieved ahead of schedule. With its ability to capture inbound demand, including in regional areas, we believe the company continues to have significant upside potential.

Would you provide an example or two of a recent addition to the Fund and the investment thesis behind it?

Koshidaka Holdings

Koshidaka Holdings is a company famously known for operating Karaoke business. The karaoke industry was one of the sectors most severely impacted by the spread of COVID-19 in 2020. The industry faced extended closures and reduced operating hours due to emergency declarations, coupled with consumer reluctance stemming from concerns about enclosed spaces and airborne droplets. This led to a prolonged period of low occupancy rates and deteriorating revenues across the industry, causing many small and medium-sized businesses to exit the market.

However, during this challenging period, Koshidaka Holdings took a bold approach by continuing to open new locations, anticipating a post-pandemic world. This strategy allowed the company to significantly increase its market share, in stark contrast to its struggling competitors. Koshidaka also focused on cost control by utilizing existing properties for new outlets and maximizing store revenue by targeting morning hours, which typically had lower occupancy rates.

We view Koshidaka’s ability to balance attractive pricing with high profitability as a key strength. The company’s proactive measures have positioned it well for a recovery in karaoke demand. Recently, as demand for karaoke has rebounded, Koshidaka has seen a strong recovery in its financial performance. Continuous expansion and increased brand recognition have further boosted its customer base.

Additionally, Koshidaka’s recent new openings are trending towards larger, urban locations. These larger, multi-room venues offer higher operational efficiency, which is expected to drive both revenue growth and profit margin improvement.

While the karaoke industry is often viewed as a mature sector with limited growth potential due to Japan’s declining population, we believe that Koshidaka can achieve growth through the continued expansion of large-format stores. This strategy not only enhances revenue but also improves profit margins, promising a robust outlook for the company.

Warabaya Nichiyo Holdings Co., Ltd.

Warabaya Nichiyo Holdings operates a ready-to-eat meal business, producing and selling bento boxes, rice balls, and prepared foods primarily for 7-Eleven convenience stores. Approximately 80% of its sales come from 7-Eleven, which has built an unshakable position in the industry through the high quality of its original products co-developed with various manufacturers, including this company. Notably, the company produces an average of about 3 million meals per day in Japan and is one of the top three vendors supplying 7-Eleven.

Historically, the company grew by establishing new factories nationwide to keep pace with 7-Eleven’s rapid store network expansion. However, since the late 2010s, the growth in new store openings has slowed, and competition among vendors has intensified, leading to a plateau in the company’s sales growth. In response to these challenges, the company has shifted its growth strategy to focus on “improving profitability of domestic operations” and “expanding its North American business.”

The company has been enhancing profitability by consolidating its domestic factories. Advances in food manufacturing technology have increased the proportion of chilled bento meals, extending product shelf life and enabling long-distance transportation, which allows for the consolidation of production facilities. Additionally, a large-scale factory is scheduled for construction, further promoting efficiency through the centralization and specialization of manufacturing sites. We believe these efforts will reduce fixed costs and improve the profit margins of the company’s domestic operations.

7-Eleven is expanding its international operations, particularly in North America, focusing on strengthening its original product offerings. Warabeya Nichiyo plays a central role in the fresh food segment, with a new factory starting operations in 2023 and another set to begin in 2025. The company expects increased sales from higher product volumes and a more diverse lineup. North America offers a favorable environment for passing on cost increases, allowing for higher profit margins compared to domestic operations. Therefore, the expansion of the North American business is expected to significantly contribute to the company’s profit growth.

Recently, the company announced a forecast for reduced profits, leading to a stock price adjustment. However, we view this short-term stagnation as a temporary setback in the company’s trajectory toward long-term growth, driven by deliberate and strategic efforts. The primary risk is a prolonged stagnation in domestic consumer demand, which could shrink the overall market for ready-to-eat meals. Nonetheless, the company’s proactive structural reforms and profitability improvement measures are progressing steadily. As the focus of its growth strategy shifts to the larger overseas markets, we believe that market perceptions of the company will evolve positively in the future.

What is your outlook for the rest of 2024 for domestic small-cap Japanese companies?

The Japanese small and mid-cap market has been underperforming compared to large-cap stocks due to delays in passing on costs caused by the rapid depreciation of the yen and company plans falling short of market expectations. However, through our research on individual companies, we believe their business environments are improving and that their plans are conservative. Under the virtuous cycle of rising wages and prices, the Japanese economy is steadily recovering. While the value gap for large-cap stocks has been steadily narrowing due to the stock price increases since last year, we believe there is still significant potential for the revaluation of small and mid-cap stocks.

Under this environment, we believe that a successful approach to investing in Japanese small and mid-cap stocks requires a deep understanding of the current situation. SPARX, with its bottom-up fundamental approach since its founding in 1989, offers a competitive solution to navigate these complexities.Under this environment, we believe that a successful approach to investing in Japanese small and mid-cap stocks requires a deep understanding of the current situation. SPARX, with its bottom-up fundamental approach since its founding in 1989, offers a competitive solution to navigate these complexities.

- In this article:

- Japan

- Japan Small Cap Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Japan Small Cap FundFinding Compelling Japanese Small-Caps

Takenari Okumura, CMAPortfolio Manager

Takenari Okumura, CMAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the Commentary

Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the CommentaryThe Portfolio Managers discuss their bottom-up approach to identifying undervalued small-cap companies and where they are currently finding opportunity.

-

Portfolio Perspective

Portfolio Perspective

Japan FundBullish on Globally Oriented Japanese Companies

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio ManagerRead the Commentary

Angus Lee, CFAPortfolio ManagerRead the CommentaryIn the following commentary, the Hennessy Japan Fund Portfolio Managers share their thoughts on the current increased market volatility, portfolio updates, and their optimism on globally oriented Japanese companies.

-

Market Outlook

Market OutlookInvestment Outlook for Japanese Equities

Read the CommentaryDespite ongoing uncertainty, our Japan portfolio managers maintain a disciplined, long-term perspective, investing in quality companies at attractive valuations.