Japanese Small-Caps: Attractive Valuations with Potential for Sustained Growth

The Portfolio Managers summarize the 2024 Japanese market and discuss the compelling opportunities they are finding in undervalued Japanese small-cap companies.

-

Takenari Okumura, CMAPortfolio Manager

Takenari Okumura, CMAPortfolio Manager -

Tadahiro Fujimura, CFA, CMAPortfolio Manager

Tadahiro Fujimura, CFA, CMAPortfolio Manager

Key Takeaways

» Nissei ASB Machine and Maeda Kosen are examples of smaller Japanese companies pursuing sustainable growth in the face of continued yen depreciation.

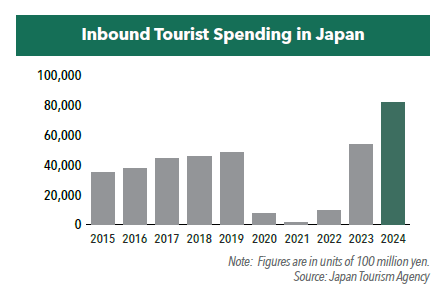

» With record tourism spending in 2024, several companies experienced a notable boost in demand from international tourists.

» We anticipate a potential shift toward a virtuous economic cycle supported by sustained wage increases, which has led to an increased allocation to domestic consumption-related stocks.

» Japanese smaller stocks remain significantly undervalued compared to their U.S. counterparts in terms of valuation. Their potential for sustained growth makes them compelling opportunities.

» Many Japanese companies are working to improve profitability while maintaining wage growth, accelerating investment in automation and labor-saving technologies and enhancing operational efficiency.

What was the most unexpected event in the Japanese market in 2024?

The most unexpected event in the Japanese market in 2024 was the unwinding of the Japanese yen carry trade, which had a significant impact on the market. This development rippled beyond the foreign exchange market, affecting Japanese equities and contributing to ongoing market instability.

Particularly from the autumn onward, heightened uncertainty surrounding policies under the newly established Shigeru Ishiba administration led to increased market volatility, prompting investors to adopt an even more cautious stance toward Japanese equities. Additionally, throughout 2024, the market remained largely driven by large-cap stocks, with capital inflows into the small- and mid-cap segments still requiring more time to materialize.

In the face of continued yen depreciation, would you please provide an example or two of smaller Japanese companies actively pursuing sustainable growth?

Nissei ASB Machine (6284): Expanding Market Reach and Enhancing Shareholder Returns

Nissei ASB Machine, a global leader in polyethylene terephthalate (PET) bottle stretch blow molding machines, generates 90% of its revenue from overseas markets, with 50% of production based in India.

Amid robust demand and yen depreciation, the company has maintained strong earnings and recently announced an entry into new markets, including beverage PET and High Density Poly Ethylene (HDPE) containers. With large-scale product development underway, Nissei ASB aims to expand market share and accelerate growth through business diversification.

At the same time, the company has revised its capital allocation strategy, raising its dividend payout ratio to reflect a greater emphasis on capital efficiency. Previously, concerns over demand volatility had led to a conservative financial stance, limiting new market entries. However, with steady increases in recurring revenue from components and molds, and growing market presence, the company is now actively investing in expansion and strengthening shareholder returns.

Maeda Kosen (7821): Scaling Up High-Value Automotive Components

Maeda Kosen, a manufacturer of industrial and civil engineering materials as well as forged wheels for automobiles, is experiencing significant tailwinds in its forged wheel business thanks to yen depreciation.

The ongoing trend toward larger-diameter wheels for luxury vehicles has driven higher unit prices, contributing to revenue growth. By investing in expanded production capacity, the company has secured continued OEM supply to major high-end automakers. Additionally, it has broadened its lineup to include magnesium wheels, further strengthening its foothold in the luxury segment.

Historically, Maeda Kosen operated under a highly conservative financial policy, maintaining an equity ratio of 80%. However, through direct discussions with the company’s leadership, we have confirmed a growing recognition of the need for strategic transformation. This shift is apparent in the company’s largest-ever M&A transaction and its ongoing review of capital return policies, which is expected to drive higher capital efficiency and improved shareholder returns.

How have smaller companies benefited from inbound tourism? Would you please discuss a portfolio company or two that directly benefited from tourist activity in 2024?

J. Front Retailing Co., Ltd., a leading department store operator, is a direct beneficiary of inbound tourism. The company is well-positioned to capitalize on luxury brand consumption by affluent inbound tourists through its department store business. In 2024, inbound tourist spending reached a record-high ¥8.14 trillion ($53 billion), surpassing pre-pandemic levels and significantly contributing to the company’s revenue growth. However, our investment in J. Front Retailing is not solely based on its inbound tourism benefits. Rather, we anticipate sustained growth driven by its urban redevelopment projects, particularly in Nagoya, one of Japan’s major cities. As these projects unfold, we will continue to closely monitor the company’s progress.

Inbound consumption has expanded beyond traditional retail, benefiting a variety of industries. Companies such as Treasure Factory, which specializes in second-hand goods, and Koshidaka, a leading karaoke chain, have also experienced a notable boost in demand from international tourists.

Would you please discuss notable portfolio changes over 2024?

Domestic consumption in Japan remains sluggish, driven by persistent inflation fueled by yen depreciation and structural labor shortages, as well as the delayed recovery of real wage growth. However, we anticipate a potential shift toward a virtuous economic cycle supported by sustained wage increases, which has led us to increase our allocation to domestic consumption-related stocks.

In particular, with inflation becoming more entrenched, we believe that the polarization of consumer spending behavior is likely to continue. Based on this outlook, we have invested in both the discount store sector, which benefits from defensive consumer spending, and the department store sector, which gains from high-end consumption trends.

Meanwhile, considering market overheating and rising valuations, we have taken profits on semiconductor-related stocks, where valuations have become increasingly stretched.

How did valuations of Japanese small-cap companies compare to their larger counterparts at the end of 2024?

Japanese small- and mid-cap stocks remain significantly undervalued compared to their U.S. counterparts in terms of valuation. However, their appeal extends beyond simply being undervalued –their potential for sustained growth makes them particularly compelling investment opportunities.

In recent years, the Japanese small- and mid-cap market has seen not only stock price appreciation driven by earnings growth but also increases in valuations resulting from changes in shareholder return policies and corporate actions such as privatizations. This trend reflects the broader penetration of corporate governance reforms, which are no longer limited to large-cap companies but are increasingly influencing small- and mid-cap stocks as well.

Japan introduced its Corporate Governance Code in 2015, but in its early years, the code lacked effectiveness, and few tangible changes were observed in corporate behavior. However, a major turning point came in 2023, when the Tokyo Stock Exchange (TSE) urged listed companies to strengthen governance reforms. In response, companies began setting concrete guidelines and targets, leading to a notable shift in management attitudes.

In recent discussions, much attention has been given to measures addressing companies with price-to-book ratios (PBR) below 1x. However, a more fundamental shift is underway—after decades of prioritizing financial soundness in the post-bubble era, Japanese companies are now transitioning toward a greater focus on capital efficiency.

An increase in corporate actions is part of this transformation. Among large-cap companies, we are seeing an acceleration in the sale of cross-shareholdings and the restructuring or downsizing of unprofitable businesses. These initiatives, particularly among firms with substantial cross-shareholdings, have played a key role in driving stock price appreciation.

Expanding the view to the broader Japanese equity market, there are still numerous companies holding excessive capital reserves (cash and equivalents), with significant room for improvement in capital efficiency. For these companies, corporate governance reforms represent a crucial opportunity to enhance corporate value.

Additionally, privatization remains a viable option for companies seeking fundamental restructuring of their business models and shareholder structures. This is particularly relevant for Japan’s small- and mid-cap segment, where many owner-operated businesses have distorted shareholder compositions. As management succession continues, the need for structural reforms to ensure long-term growth is becoming increasingly evident.

Given these evolving dynamics, we believe that the Japanese small- and mid-cap market presents substantial investment opportunities, particularly for investors seeking corporate value enhancement driven by proactive governance reforms and strategic restructuring.

Would you please provide your outlook on the positioning of the Hennessy Japan Small Cap Fund?

Moving forward in 2025, heightened geopolitical risks and economic slowdowns in China and Europe are expected to remain key concerns for the market. These uncertainties may continue to weigh on investor sentiment.

However, shifting our focus to Japan’s domestic economy, there is a strong outlook for continued wage increases. This improvement in income conditions has the potential to revitalize private consumption, which has long remained sluggish.

At the same time, Japanese companies are not merely absorbing cost increases. Instead, many companies are actively working to improve profitability while maintaining wage growth, accelerating investment in automation and labor-saving technologies as well as enhancing operational efficiency. These initiatives are expected to create

a positive economic cycle, ultimately serving as a tailwind for corporate earnings.

In particular, highly competitive companies are well-positioned to expand their growth opportunities through market differentiation. Even in a challenging economic environment, firms with strong competitive advantages could further solidify their positions through strategic business investments and corporate reforms.

With the Hennessy Japan Small Cap Fund, we will continue to focus on a bottom-up investment approach, seeking overlooked opportunities in the market. Rather than being swayed by short-term trends, we remain committed to identifying companies with fundamental value and long-term growth potential, aiming to generate sustainable returns for our investors.

- In this article:

- Japan

- Japan Small Cap Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Japan FundJapan’s Evolving Investment Landscape in 2025

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio ManagerRead the Commentary

Angus Lee, CFAPortfolio ManagerRead the CommentaryIn the following commentary, the Hennessy Japan Fund Portfolio Managers summarized what most surprised them in 2024 about the Japanese market along with positive trends driving Japanese companies.

-

Investment Idea

Investment IdeaCompelling Valuations in Japan

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio Manager

Tadahiro Fujimura, CFA, CMAPortfolio Manager Takenari Okumura, CMAPortfolio ManagerRead the Investment Idea

Takenari Okumura, CMAPortfolio ManagerRead the Investment IdeaJapanese equities are currently trading at compelling valuation levels compared to other developed equity markets around the world and relative to their own historical averages. We believe the Japanese market deserves a closer look.

-

Investment Idea

Investment IdeaWhy Active Matters When Investing in Japan

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio Manager

Angus Lee, CFAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio Manager

Tadahiro Fujimura, CFA, CMAPortfolio Manager Takenari Okumura, CMAPortfolio ManagerRead the Investment Idea

Takenari Okumura, CMAPortfolio ManagerRead the Investment IdeaWhen investing in Japanese businesses, we believe it is imperative to select a manager who is immersed in the culture and can perform in-depth, company-specific research to build a concentrated portfolio of Japanese companies that can outperform a benchmark and weather volatility.