Why Active Matters When Investing in Japan

When investing in Japanese businesses, we believe it is imperative to select a manager who is immersed in the culture and can perform in-depth, company-specific research to build a concentrated portfolio of Japanese companies that can outperform a benchmark and weather volatility.

-

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager -

Angus Lee, CFAPortfolio Manager

Angus Lee, CFAPortfolio Manager -

Tadahiro Fujimura, CFA, CMAPortfolio Manager

Tadahiro Fujimura, CFA, CMAPortfolio Manager -

Takenari Okumura, CMAPortfolio Manager

Takenari Okumura, CMAPortfolio Manager

Japan is a market ripe for active, research-oriented managers for the following reasons:

1. Indices are Dominated by “Sleepy Giants”

The major Japanese indices are dominated by large, mature, low-growth companies. However, just below this top tier in terms of size, there are many high-quality, long-term growth opportunities not well-represented in the indices.

2. Language Barriers and Corporate Culture

Japan remains a mystery for many U.S. investors as language barriers, a unique corporate culture, and business operating environment make the country a difficult market for foreign investors to understand. In-country managers and research teams can understand the nuances of Japan and develop relationships with Japanese corporate management, correctly interpreting and translating research into winning investment ideas.

3. Inexperienced Investor Base

Many financial institutions, such as pension funds, are staffed with managers who typically rotate out of their position after a couple of years. As a result, institutional managers tend to have a thin knowledge base and lack experience through full market cycles. Further, local retail investors do little research and, conditioned to expect poor returns, trade the market with a short-term orientation.

Buy the Manager, Not the Market

We believe the best way to access the Japanese market is through active management. The Hennessy Japan Fund offers:

1. Experienced, “Feet on the Street” Management

The Hennessy Japan Fund is sub-advised by Tokyo-based SPARX Asset Management, one of the largest and most experienced independent Asia-based asset management specialists. SPARX has experienced professional money managers who practice a research-intensive investment process and have a deep understanding of the inner workings of corporate Japan.

2. Impressive Excess Returns

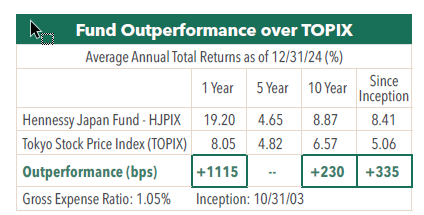

Over the past 10 years through December 31, 2024, the Fund (HJPIX) provided strong excess returns, delivering an alpha of 2.43 relative to the Tokyo Stock Price Index (TOPIX).

3. Consistently Strong Performance

The Japan Fund (HJPIX) has significantly outperformed the Tokyo Stock Price Index (TOPIX) over the 1-, 10-year and since inception periods.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting hennessyfunds.com.

Standardized performance can be obtained by viewing the fact sheet or by clicking here.

- In this article:

- Japan

- Japan Fund

- Japan Small Cap Fund

You might also like

-

Company Spotlight

Company Spotlight

Japan FundSeven & i Holdings Co., Ltd. - Poised to Become A Global Retail Champion

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio ManagerRead the Spotlight

Angus Lee, CFAPortfolio ManagerRead the SpotlightSeven & i operates a diverse range of businesses, including the convenience store chain, 7-Eleven. Seven & i aims to become a world-class food-focused retail group, utilizing technologies and providing new experiences. Recent shareholder activism and acquisition offers demonstrate the company’s attractiveness to investors.

-

Portfolio Perspective

Portfolio Perspective

Japan FundJapan’s Evolving Investment Landscape in 2025

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio ManagerRead the Commentary

Angus Lee, CFAPortfolio ManagerRead the CommentaryIn the following commentary, the Hennessy Japan Fund Portfolio Managers summarized what most surprised them in 2024 about the Japanese market along with positive trends driving Japanese companies.

-

Portfolio Perspective

Portfolio Perspective

Japan Small Cap FundJapanese Small-Caps: Attractive Valuations with Potential for Sustained Growth

Takenari Okumura, CMAPortfolio Manager

Takenari Okumura, CMAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the Commentary

Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the CommentaryThe Portfolio Managers summarize the 2024 Japanese market and discuss the compelling opportunities they are finding in undervalued Japanese small-cap companies.