Japan's Tourism Industry Taking Off

Tourism is a growing industry in Japan, and it has the potential to contribute meaningfully to economic growth over the next decade as the country deregulates the industry, opens casinos, and welcomes foreign visitors to the Olympic Games in 2020.

-

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager -

Tadahiro Fujimura, CFA, CMAPortfolio Manager

Tadahiro Fujimura, CFA, CMAPortfolio Manager

Key Takeaways

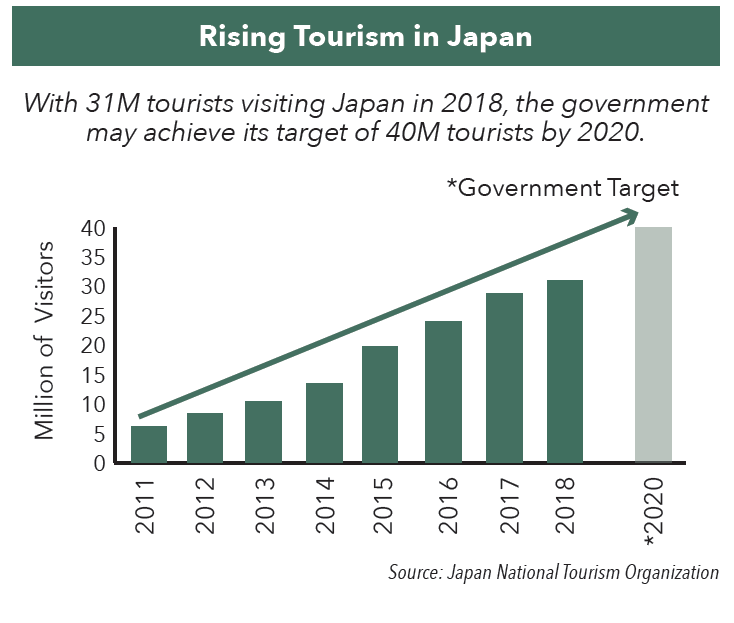

- Tourism has the potential to be a positive economic influence in Japan

- The country is set to meet the government’s target of 40 million tourists by 2020

- The 2020 Olympics in Tokyo provide an opportunity for Japan to expand its tourist base beyond Asia

A decade ago, few tourists visited Japan in comparison with other international destinations. However, over the past five years, the number of tourists has increased by over 24% annually, and the number is expected to continue to rise. With the average tourist spending $1,321 in Q2 2018, tourism in total currently equates to approximately 0.8% of Japan’s gross domestic product (GDP), although the broader impact is estimated to equal about 2.2% of GDP. We believe tourism has the potential for robust growth, and as it expands, its impact on overall economic growth could be significant.

Promoting Tourism

The government has made tourism an important part of its goal to reach 600 trillion yen ($5 trillion) in nominal GDP by 2020. Over the last couple of years, the government has enacted a series of policy changes aimed at turning Japan into a “tourism-oriented country,” which include the relaxation of visa requirements and an increase in the number of low-cost air carrier routes. In 2018, a record 31 million tourists visited Japan, an 8% increase over 2017.1 Visitors from Asian countries continue to dominate, with tourists from China, South Korea, Taiwan, Hong Kong, and Thailand accounting for 75% of total visits in November 2018.

Spending by foreign tourists in the six-month period through June 2018 reached 2.24 trillion yen ($20.4 billion), up 9.3% from a year earlier. The depreciation of the yen has made Japanese goods and services more affordable to foreigners, supporting growth in spending in yen terms.2

Growth Potential

We believe tourism in Japan has ample room to grow, as the total number of visitors remains small compared to many other countries. For example, in France, the world’s top tourist destination with 87 million foreign tourists in 2017, the tourism industry accounted for 9% of GDP in 2017. Tokyo was ranked 9th in terms of international visitor spending in 2017. However, total expenditures of almost $12 billion were still substantially lower than the $17 billion tourists spent in London or Singapore.

Casinos

Casino resorts could further boost tourism growth. In December 2016, the Japanese parliament approved a bill to legalize casino gambling, and in July 2018 authorized the construction of three resort casinos. The first is likely to open in 2025, and total gaming revenue from all three is expected to top $12 billion. The Asia-Pacific region has become the largest casino gambling market, with revenue in Macau reaching nearly $38 billion in 2018.3 By comparison, gaming revenue in Las Vegas is expected to be about $6 billion in 2018.

2020 Olympic Games

The 2020 Summer Olympic Games in Tokyo are likely to be a big draw for tourists to Japan. In preparation for the games, it is estimated that Japan will spend approximately 6 trillion yen ($53 billion) on transportation infrastructure, including expanding ports, increasing airport capacity, and strengthening transportation hubs.4

The 2020 Games will provide an opportunity to showcase Japan’s technological know-how. Plans include the creation of an Olympic robot village to help guests with directions, transportation, and translation. Japan plans to impress athletes and tourists with autonomous taxis, 5G wireless technology, and superspeed magnetic levitation trains and hopes to draw visitors from all over the world, including the U.S. and Europe.5

An Opportunity to Benefit from Japan’s Growth

Tourism is one of many areas contributing to the recovery of Japan’s economy. For investors seeking exposure to Japan’s potential growth, consider the Hennessy Japan Fund (HJPNX/HJPIX) and the Hennessy Japan Small Cap Fund (HJPSX/HJSIX), both offering “best ideas” portfolios. The Japan Fund is comprised of globally oriented mid- to large-cap companies. The Japan Small Cap Fund invests in smaller-cap, more domestically focused companies.

Both Funds are sub-advised by Tokyo-based SPARX Asset Management. As one of the largest and most experienced independent Asia-based asset management specialists, SPARX’s “feet on the street” research team provides a significant and crucial advantage for shareholders.

- In this article:

- Japan

- Japan Fund

- Japan Small Cap Fund

You might also like

-

Portfolio Perspective

Portfolio Perspective

Japan Small Cap FundFinding Compelling Japanese Small-Caps

Takenari Okumura, CMAPortfolio Manager

Takenari Okumura, CMAPortfolio Manager Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the Commentary

Tadahiro Fujimura, CFA, CMAPortfolio ManagerRead the CommentaryThe Portfolio Managers discuss their bottom-up approach to identifying undervalued small-cap companies and where they are currently finding opportunity.

-

Portfolio Perspective

Portfolio Perspective

Japan FundBullish on Globally Oriented Japanese Companies

Masakazu Takeda, CFA, CMAPortfolio Manager

Masakazu Takeda, CFA, CMAPortfolio Manager Angus Lee, CFAPortfolio ManagerRead the Commentary

Angus Lee, CFAPortfolio ManagerRead the CommentaryIn the following commentary, the Hennessy Japan Fund Portfolio Managers share their thoughts on the current increased market volatility, portfolio updates, and their optimism on globally oriented Japanese companies.

-

Market Outlook

Market OutlookInvestment Outlook for Japanese Equities

Read the CommentaryDespite ongoing uncertainty, our Japan portfolio managers maintain a disciplined, long-term perspective, investing in quality companies at attractive valuations.